2025/9/25

Since the beginning of 2025, the national economy has been operating smoothly and steadily, but the international trade environment still remains highly complex and volatile. The chemical fiber industry faces more significant challenges. In the first half of the year, the “strong supply and weak demand” has eased, with production growth gradually slowing down; however, the industry’s operating income declined in the first quarter, further turning the overall profit growth rate from positive to negative. Profitability pressures are now evident. Additionally, supported by demand in some emerging markets and expanded diversified trade channels of enterprises, chemical fiber exports continue to grow rapidly.

I. Production & Inventory

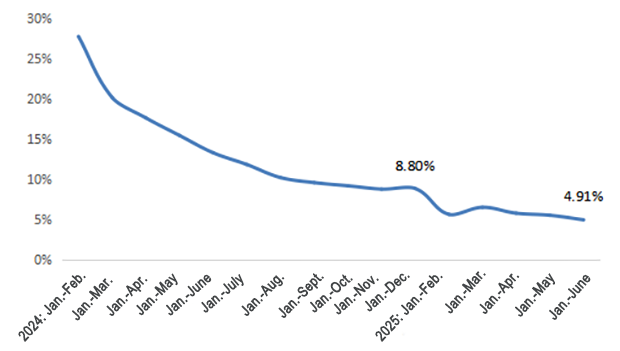

In the first half of the year, the overall operation of the chemical fiber industry was generally normal, with some differences in the operating load across various sub-industries. The polyester filament industry quickly resumed production after the Spring Festival, and the average start rate in March reached its highest point of the year. Moving into the second quarter, due to insufficient demand support, some companies began reducing their production loads. As a result, the industry’s average operating load declined by about 5 percentage points from its peak. The spandex and polyamide industries, which experienced demand growth and capacity expansion earlier, faced greater market pressure in the first half of the year due to a supply and demand imbalance. Consequently, the industry’s average operating rate fell by 3 percentage points year-on-year. In July, compounded by the traditional demand off-season, the industry’s operating load further declined. According to data from the National Bureau of Statistics, chemical fiber output grew by 4.91% year-on-year from January to June 2025, with the growth rate slowing compared to the same period in 2024 and the entire year (Figure 1).

Figure 1: The Growth Rate of Chemical Fibers Output from the Beginning of 2024

Source: National Bureau of Statistics, China Chemical Fibers Association (CCFA)

Regarding inventory, in the first quarter of this year, most sub-industry inventories showed only a slight rebound. Moving into the second quarter, some sub-industries experienced a backlog of inventory and profitability pressures, leading to the initiation of production reduction measures. As a result, inventory pressure has been somewhat alleviated.

II. Market & Price

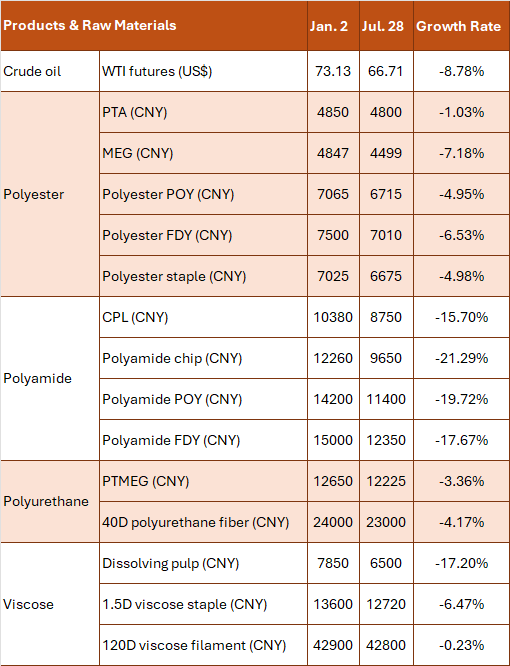

Crude oil prices have experienced rapid fluctuations since the beginning of 2025. There was a steady decline from US$80/bbl on January 15 to US$57/bbl on May 5, mainly because of OPEC+ surpassing expected production increases and Trump’s tariff policies driven by pessimistic demand forecasts. In June, escalating tensions in the Middle East caused a sharp rise to US$75/bbl on June 18, but prices quickly dropped back to US$65/bbl by June 25 after a cease-fire was reached, and they have remained low since then. Chemical fiber prices followed crude oil fluctuations within a narrow range.

Table 1: Price Change of Main Chemical Fibers and Raw Materials Since the Beginning of 2025

Source: China Customs

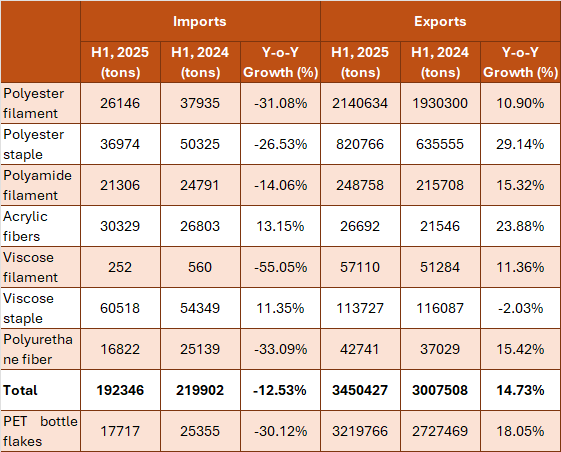

III. Foreign Trade

According to China Customs data, from January to June, the main products of chemical fiber exports totaled 3.45 million tons, representing a 14.73% increase year-on-year. Among them, polyester staple exports grew by 29.14% year-on-year. Notably, in May, polyester staple exports reached 160,000 tons, the highest level for a single month in nearly 11 years. The recent faster growth rate in polyester staple exports is mainly due to strong demand from Southeast Asia, South Asia, and other regions for China’s polyester staple and related raw materials.

Table 2: Foreign Trade of Chemical Fiber Products in H1, 2025

Source: Based on data from China Customs

IV. Domestic sales & foreign sales

This year, the domestic macroeconomic situation remains generally stable. The country is promoting consumption through special initiatives to support steady growth. Chinese residents’ demand for clothing continues to increase, and market supply keeps improving. Driven by domestic sales, textiles and clothing experience moderate growth. Trends such as Chinese chic, health textiles, and green low-carbon products are revitalizing consumption, with related categories steadily boosting their sales on leading e-commerce platforms. Live e-commerce and other industry modes continue to enhance consumption. Online shopping events are driving growth in both online and offline sales of textiles and clothing.

Regarding foreign sales in the second quarter, exports fluctuated due to U.S. tariff policies. Leveraging their competitive advantages across the entire industrial chain and international layout, China’s textile foreign trade enterprises swiftly adjusted their strategies, responded to external changes, and aimed to reduce risks. The main export markets experienced a sharper decline in exports to the United States, with a 5.3% year-on-year drop in the first half of the year. Meanwhile, foreign trade enterprises actively expanded into diverse markets, achieving robust export growth with trading partners such as the European Union, the United Kingdom, South Korea, Canada, Pakistan, Chile, Nigeria, and others.

V. Revenue & Benefits

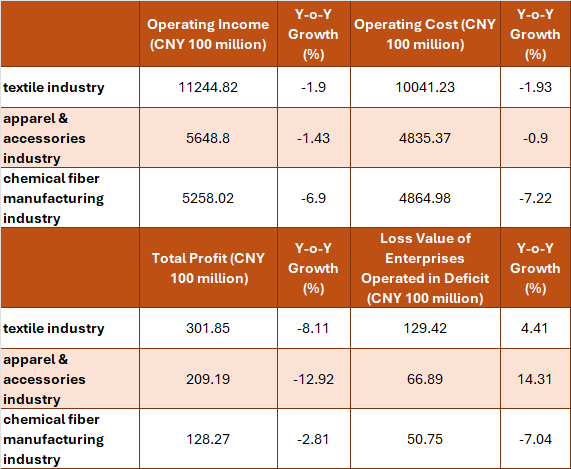

Crude oil prices dropped in the first quarter, and the decrease in raw material costs created opportunities for profit growth in midstream and downstream companies. However, in the second quarter, weak demand exposed the industry’s lack of profitability resilience. This highlighted an imbalance between supply and demand, cost control, and market competition. There is rising pressure on industry profitability. The polyester industry, through self-discipline to cut production, has somewhat boosted profit margins.

Data from the National Bureau of Statistics show that from January to June, the operating income of the chemical fiber industry declined by 6.9% year-on-year, and total profits fell by 2.81% (Table 3). Among them, sub-industries like polyester, polyamide, and spandex experienced total profit reductions of 10.78%, 3.79%, and 11.89% respectively. Meanwhile, the lyocell fiber industry performed well, as its advancements in technology and market demand significantly boosted production, helping it shift from high inventory to zero inventory and from losses to profits.

Table 3: Economic Benefit of Chemical Fiber and Related Industries in H1, 2025

Source: National Bureau of Statistics

VI. Investment

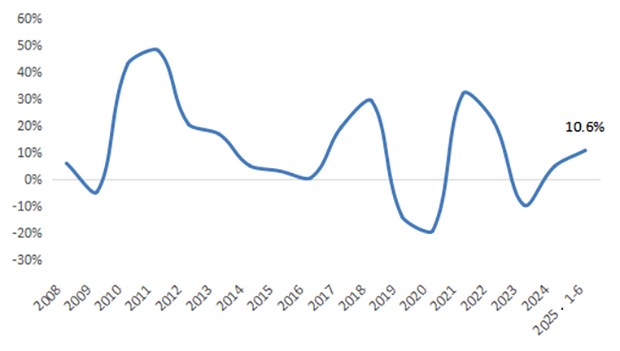

The data from the National Bureau of Statistics show that investment in fixed assets within the chemical fiber industry increased by 10.6% year-on-year in the first half of the year, but this growth narrowed by 5.2 percentage points compared to the first quarter (Figure 2). Regarding the industry’s actual new capacity, after excluding capacity relocation and the transformation of old facilities, polyester filament added about 850,000 tons. There was no new capacity for polyester staple, which has eased the pressure on capacity growth.

Figure 2: Fixed-Assets Investment Growth(Y-o-Y) of the Chemical Fiber Industry from 2008 to H1, 2025

Source: National Bureau of Statistics

Source: CHINA TEXTILE LEADER Express

Authority in Charge: China National Textile and Apparel Council (CNTAC)

Sponsor: China Textile Information Center (CTIC)

ISSN 1003-3025 CN11-1714/TS

© 2026 China Textile Leader, all rights reserved.

Powered by SeekRay