2025/9/25

Since 2025, the international environment has been complex and volatile. The United States’ “reciprocal tariffs” policy impacts international trade rules; global economic and trade patterns have been reshaped, affecting China’s textile and apparel exports. The domestic consumption market has gradually regained vitality with policy support, but the consumer environment and residents’ willingness to spend still need further improvement. Despite a challenging and difficult situation, China’s printing and dyeing industry has withstood pressure, maintaining overall stability in the first half of the year. Production of printed and dyed fabrics saw a slight increase, and exports of main products continued to grow, further demonstrating the industry’s resilience in foreign trade. However, competition has intensified, export unit prices for printed and dyed fabrics have dropped significantly, and the industry faces considerable pressure to improve quality and efficiency. The second half of the year still presents many problems and challenges to smooth development.

I. Production

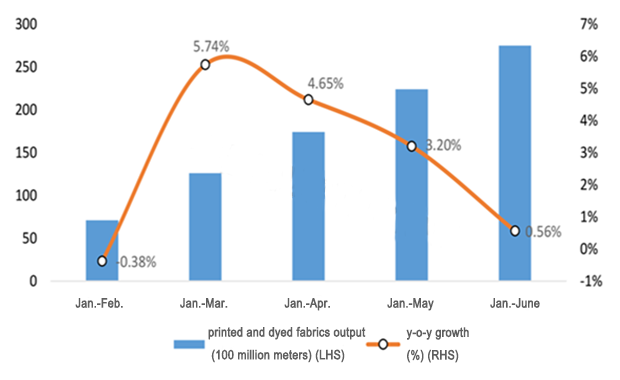

According to the National Bureau of Statistics, the output of printed and dyed fabrics by enterprises above designated size in the printing and dyeing industry increased by 0.56% year-on-year in the first half of 2025, with the growth rate declining by 5.18 percentage points compared to the first quarter. Domestic sales of textiles and apparel experienced moderate growth, complemented by export promotion efforts during the tariff suspension period, which helped China’s printed and dyed fabric production continue to grow.

Figure 1: Printed and Dyed Fabrics Output of Enterprises Above Designated Size in China in H1, 2025

II. Exports

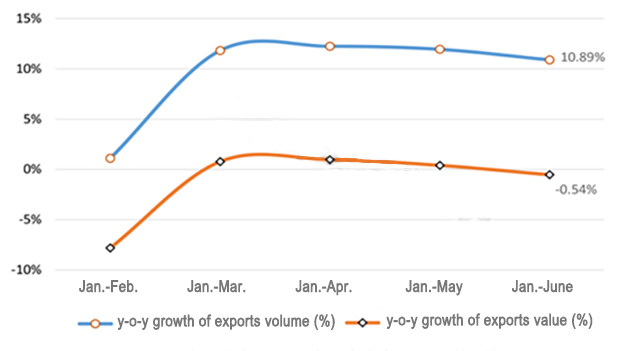

According to the statistics released by China General Customs, the export volume of eight major categories of printed and dyed products, i.e., dyed cotton fabric, printed cotton fabric, dyed cotton-blended fabric, printed cotton-blended fabric, synthetic filament fabric, polyester staple fabric, printed and dyed T/C fabric, man-made staple fabric, totaled 17.98 billion meters in the first half of 2025, up by 10.89% year-on-year, 8.16 percentage points higher than the same period of last year. The export value reached US$15.31 billion, with a year-on-year decline of 0.54%. The average export unit price was US$0.85/meter, declining by 10.30% year-on-year.

Since the second quarter, shifts in global textile and apparel trade patterns and increased supply chain risks triggered by U.S. tariff policies have pressured China’s printing and dyeing industry exports. However, the industry still demonstrates strong resilience and competitiveness internationally, with exports of major printed and dyed products continuing to grow faster in the first half of the year. By 2025, the export growth rate of eight major categories of printed and dyed products surpassed growth in export value for the same period. This indicates that the average unit price of product exports is still trending downward; in the first half, the average unit price for these eight categories dropped to its lowest level since 2007. Due to tariffs, market competition has become even more intense.

Figure 2: The Export Growth Rate of Eight Major Categories of Printed and Dyed Products in China in H1, 2025

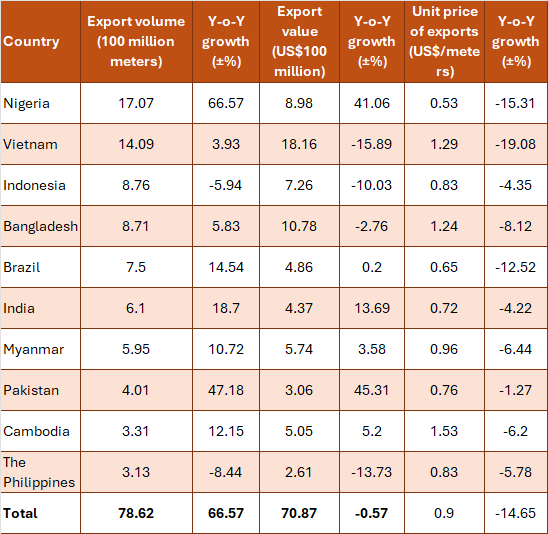

In the first half of the year, China’s exports of its eight major printed and dyed products to ASEAN totaled 4.08 billion meters, a 2.62% increase year-on-year, representing 22.71% of the total; their export value reached US$4.38 billion, reflecting an 8.68% decline compared to the previous year. The average export price was US$1.07 per meter, down 11.01% year-on-year. Since the beginning of this year, the United States has imposed tariffs unilaterally on ASEAN countries, along with trade barriers related to U.S. rules of origin, which have resulted in weaker performance for China’s printed and dyed fabric exports to ASEAN compared to the overall export situation. The growth rate of export volume of these eight major printed and dyed products to ASEAN is 8.27 percentage points lower than the overall growth rate. As ASEAN is an important member of the RCEP, the same trend is evident there as well. During this period, the export volume of these eight major categories of printed and dyed products to RCEP member countries reached 4.35 billion meters, a 2.77% increase year-on-year. The average export price was US$1.06 per meter, declining by 10.71% compared to last year.

Since the slowdown in exports to ASEAN, China’s printing and dyeing industry has sped up its expansion into other export markets. In the first half of the year, the export volume of China’s eight major printed and dyed products to Nigeria, Brazil, India, Pakistan, and other countries experienced faster growth. Among them, Nigeria and Pakistan saw a year-on-year surge of 66.57% and 47.18%, respectively, and exports to India grew by nearly 20%.

Table: Performance of Top Ten Destinations of China’s Eight Major Categories of Printed and Dyed Products in H1, 2025

III. Operation quality and efficiency

Currently, the main operational quality indicators of China’s printing and dyeing industry remain low, and overall operational efficiency is also low. According to the National Bureau of Statistics data, the share of three overheads in turnover was 7.30% in the first half of 2025, up 0.36 percentage points year-on-year, indicating rising business operating costs. The turnover rate of finished products was 12.74 times per year, a decrease of 7.99% from the previous year; the turnover of accounts receivable was 7.49 times per year, down 4.79% year-on-year; and the total asset turnover was 0.91 times per year, a decline of 7.01% compared to last year.

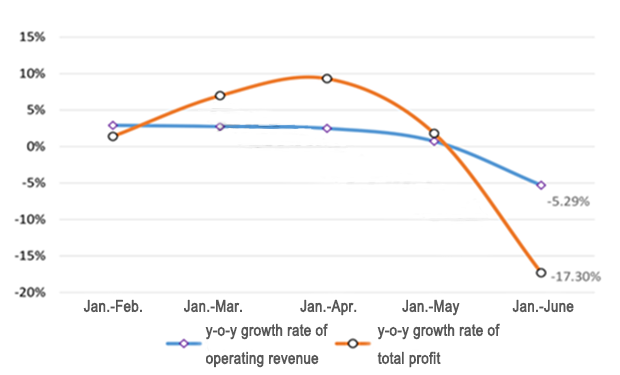

The National Bureau of Statistics data showed that the operating income of China’s printing and dyeing enterprises above the designated size declined by 5.29% year-on-year. Their profits fell by 17.30% compared to the previous year. The operating income margin was 3.55%, which is 0.51 percentage points lower than the same period last year. About 39.54% of printing and dyeing enterprises operated at a loss, totaling 1.92 billion yuan, a decrease of 7.39% year-on-year. In the second quarter, the growth rate of the main economic efficiency indicators for the printing and dyeing industry shifted from positive to negative. Especially in June, the growth of operating income and total profit declined sharply, putting significant pressure on the operations of printing and dyeing enterprises.

Figure 3: Main Economic Indicators of the Printing and Dyeing Enterprises Above the Designated Size in H1, 2025

Source: CHINA TEXTILE LEADER Express

Authority in Charge: China National Textile and Apparel Council (CNTAC)

Sponsor: China Textile Information Center (CTIC)

ISSN 1003-3025 CN11-1714/TS

© 2026 China Textile Leader, all rights reserved.

Powered by SeekRay