2025/9/25

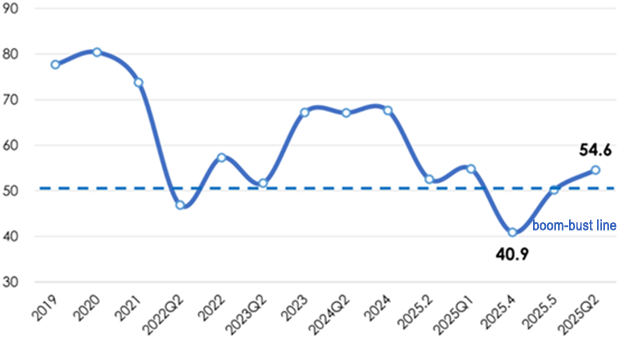

In the first half of 2025, the global economic recovery is weak, unilateralism and protectionism have intensified, and multilateralism along with free trade face severe challenges; meanwhile, domestic economic operations in China remain generally stable and strong, demonstrating resilience and vitality amid a complex and volatile environment both at home and abroad. China’s technical textiles industry successfully overcame the impact of multiple unfavorable factors domestically and internationally, maintaining a stable and growing trend. According to the research of China Nonwovens & Industrial Textiles Association (CNITA), the prosperity index of China’s technical textiles industry in the first half of 2025 was 54.6, within the micro-prosperity zone (Figure 1).

Figure 1: Prosperity Index of China’s Technical Textiles Industry

I. Market Demand and Production

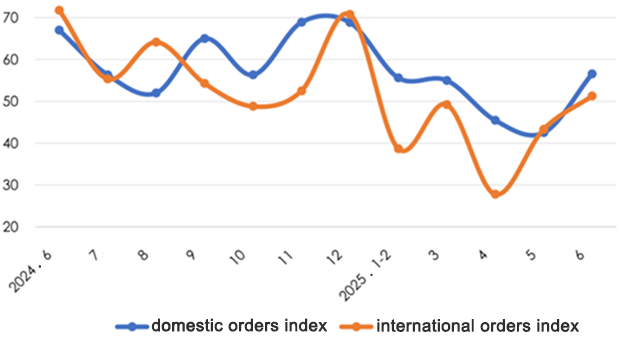

According to the Association’s research on key member enterprises, in the first half of 2025, the domestic and international order indexes of the technical textiles industry reached 56.6 and 51.3, respectively (Fig. 2), and the Sino-US trade negotiations stabilized market expectations; the capacity utilization rate of industry enterprises generally stayed around 70%; these companies also sped up the phase-out and upgrading of old equipment. According to data from the National Bureau of Statistics, the output of nonwovens enterprises above a designated size reached 3.31 million tons from January to June 2025, a 4.5% increase year-on-year, with 730,000 tons exported, up 12% year-on-year; the output of cord fabric (in tires) reached 511,000 tons, decreasing by 0.3% year-on-year.

Figure 2: Market Demand for Technical Textiles Industry at Home and Abroad from June 2024 to June 2025

II. Economic Benefits

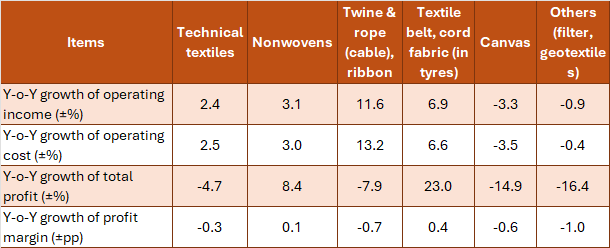

Throughout 2024, China’s technical textiles industry’s operating income growth rate stayed around 6%, but it gradually slowed after entering 2025. According to the National Bureau of Statistics, from January to June 2025, the operating income of enterprises above designated size in China’s technical textiles industry rose by 2.4% year-on-year. The industry saw a sharp rebound in total profit in 2024 after a decline during 2022-2023, with annual profits increasing by 10.1%. However, since the first quarter of 2025, the industry’s total profit has started to decline again, totaling 5.24 billion yuan, with a 4.7% decrease year-on-year. The profit margin for these enterprises in the first half was 3.7%, down 0.2 percentage points compared to the same period in 2024, remaining at a historical low.

In the first half of 2025, the economic benefits across different sectors of China’s technical textiles industry showed mixed trends. After the COVID-19 pandemic, nonwoven capacity grew quickly, while demand for medical and hygiene textiles dropped, putting more adjustment pressures on the industry. The price of finished goods mainly influenced industry profits, but decreases in raw material prices also helped lessen profitability pressures somewhat.

Table 1: Key Economic Indicators of Major Products Above Designated Size of China’s Technical Textile Industry in H1, 2025

III. International Trade

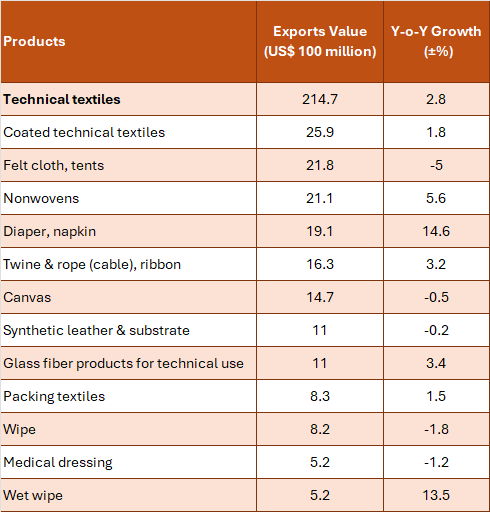

According to China Customs data, the export value of China’s technical textiles industry (customs 8-digit HS code statistics) from January to June 2025 totaled US$21.47 billion, seeing an increase of 2.8% year-on-year; the imports reached US$2.67 billion, up 4.1% year-on-year (Table 2).

The United States, Vietnam, Japan, South Korea, and India are the main destinations of China’s technical textiles exports, making up about one-third of the total. The United States remains the largest single market for China’s technical textile exports. Due to tariffs, China’s technical textiles exports to the United States were valued at US$2.59 billion from January to June 2025, seeing a 5% decrease compared to the previous year. Exports to other major markets have continued to grow at different rates.

Table 2: The Exports of Main Products in China’s Technical Textile Industry in H1, 2025

Source: China Customs

Source: CHINA TEXTILE LEADER Express

Authority in Charge: China National Textile and Apparel Council (CNTAC)

Sponsor: China Textile Information Center (CTIC)

ISSN 1003-3025 CN11-1714/TS

© 2026 China Textile Leader, all rights reserved.

Powered by SeekRay