2025/9/24

According to the General Administration of Customs, China’s textile and apparel exports in the first eight months amounted to US$197.27 billion, reflecting a slight year-on-year decrease of 0.2%. Among them, textile exports totaled US$94.51 billion, rising by 1.6% year-on-year, while apparel exports reached US$102.76 billion, decreasing by 1.7% year-on-year.

In CNY-denominated terms, textile and garment exports totaled 1.42 trillion yuan, marking a 0.8% year-on-year increase. Specifically, textile exports were 678.75 billion yuan, up by 2.6% year-on-year; apparel exports amounted to 738 billion yuan, decreasing by 0.7% year-on-year.

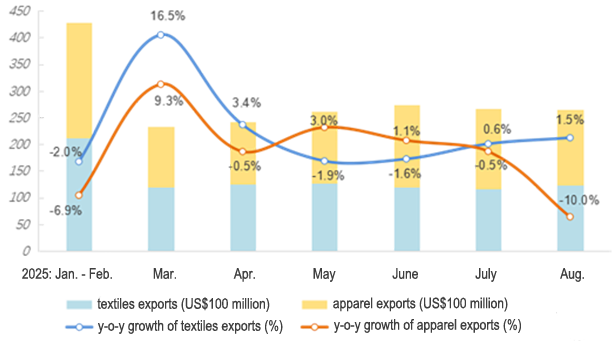

Figure: Monthly Statistics of China’s Textiles and Apparel Exports from January to August, 2025

Since the beginning of this year, the pace of global economic recovery has been uneven. The United States, the European Union, and other major markets maintain high interest rate levels, resulting in a slow recovery of consumption and import demand. Some countries’ trade policies and tariff adjustments also impact China’s textile foreign trade orders. Additionally, frequent fluctuations in international shipping costs and the renminbi exchange rate put pressure on export costs and profit margins. Into the third quarter, China’s textile and apparel export performance continues to diverge: textile exports remain resilient, with August recording US$12.39 billion, seeing a 1.5% year-on-year increase; meanwhile, apparel exports declined significantly, with August exports at US$14.15 billion, dropping 10% year-on-year, expanding the decline rate by 9.5 percentage points from July.

Overall, the international trade environment remains uncertain, and the global textile and apparel export may continue to fluctuate. It is recommended that China’s textile enterprises closely monitor demand and policy changes in key export markets, reasonably plan production capacity and delivery schedules, and pay attention to exchange rate and freight fluctuation risks. At the same time, they should leverage new domestic consumption demands, optimize product and channel strategies, improve order quality and delivery stability, and enhance the ability to develop both domestic and foreign markets in a coordinated manner.

Source: CHINA TEXTILE LEADER Express

Authority in Charge: China National Textile and Apparel Council (CNTAC)

Sponsor: China Textile Information Center (CTIC)

ISSN 1003-3025 CN11-1714/TS

© 2026 China Textile Leader, all rights reserved.

Powered by SeekRay