2024/3/15

In 2023, the knitting industry is encountering a difficult external environment, which includes the lasting effects of the post-COVID-19 pandemic, geopolitical conflicts, and increasing power struggles among major countries. These factors have led to a decrease in demand from overseas and changes in the international order, putting pressure on the operational quality and efficiency of China’s knitting industry. Despite the industry facing pressure and difficulties in 2023, there was a slight improvement in revenue, profits, and exports.

01 General Performance

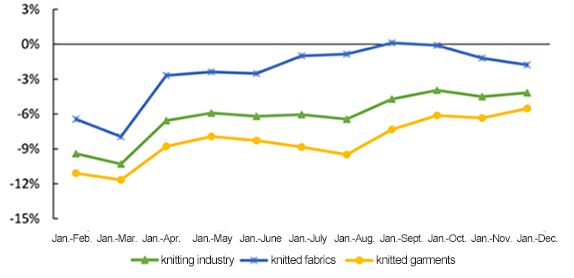

According to the National Bureau of Statistics data, the main business income of knitting enterprises above designated size decreased by 4.17% year-on-year in 2023, 0.55 percentage points narrower than that of the first three-quarters last year. Among them, that of knitted fabrics enterprises declined by 1.78% year-on-year; knitted garments enterprises saw a year-on-year decline in business income of 5.53%.

Figure 1: The Growth Rate of the Main Business Income of Knitting Enterprises Above Designated Size, 2023

Source: National Bureau of Statistics

Although the year-on-year growth in knitted apparel production contracted, the production of knitted outerwear fabrics was boosted by continued innovation in consumer scenarios and the shift in consumer habits towards athleisure. The development of knitted garments such as shirts, suits, and women's jackets has improved rapidly, and the share of knitted garments has continued to rise. Currently, the proportion of knitted garment production has reached 66.19% of the total, which is 4.06 percentage points higher than in 2022.

02 Profitability

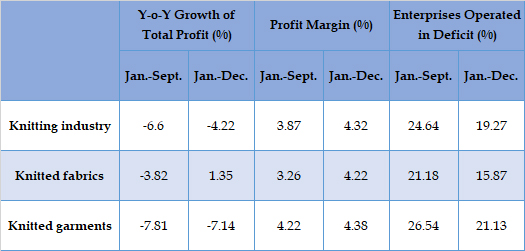

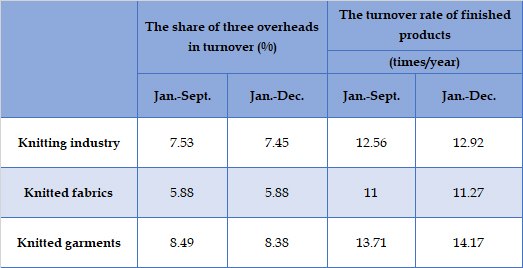

In 2023, the total profits of knitting enterprises above designated size fell 4.22% year-on-year, 2.38 percentage points narrower than that of the first three quarters. Knitted fabrics performed better than knitted garments. The profits from knitted fabric increased by 1.35%, showing positive growth, while profits from knitted garments fell by 7.14% year-on-year. Other main economic indicators are as follows.

Table 1: The Main Economic Indicators of Knitted Enterprises Above Designated Size, 2023

Source: National Bureau of Statistics

03 Domestic sales

In 2023, the annual GDP surpassed CNY 126 trillion, showing a 5.2% increase from the previous year. The total retail sales of consumer goods for the year were about CNY 47 trillion, marking a 7.4 percentage points rise from 2022. Among them, the retail sales of clothing, foot and head wear, and knitted textiles above designated size increased by 12.9% year-on-year.

In the online retail sales of physical commodities, wearing goods increased by 10.8% year-on-year.

With the gradual recovery of offline activities, brands are delving deep and innovating in specific areas. Lightweight outdoor knitwear, like high-tech sun suits, hardshell jackets, and ski apparel, are popular. Outdoor children's clothing is also gaining popularity. Chinese fashion trend becomes the new hit. Consumers are becoming more rational, shifting their focus from "cost-effective" to "mind-orientation." White label has become a popular term for consumers, providing the opportunity for processors and brands.

04 Foreign Trade

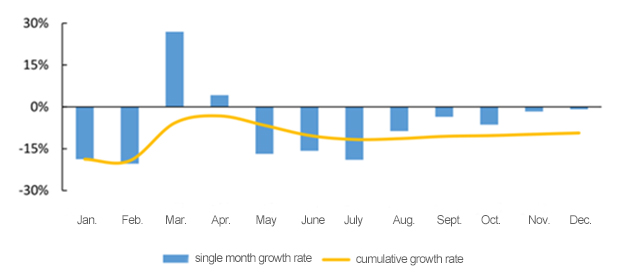

China’s exports of knitted products surpassed $100 billion for the third consecutive year during the 14th Five-Year Plan period (2021-2025), reaching US$ 104.09 billion in 2023. Among them, knitted fabric exports US$ 21.52 billion, down 9.3% year-on-year; knitted garments and accessories exports US$ 82.57 billion, down 7.8% year-on-year.

Figure 2: Export Growth of China’s Knitting Industry in 2023 by value

Source: National Bureau of Statistics

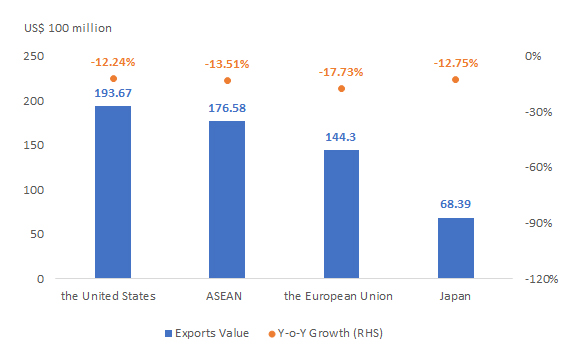

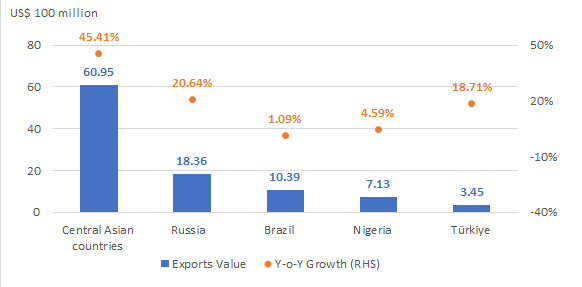

From the perspective of the export market, China’s knitted products export structure is continually adjusting, and the trade market is becoming more diversified. In 2023, China's exports of knitted products to the United States, ASEAN, the European Union, and Japan decreased by 12.24%, 13.51%, 17.73% and 12.75% year-on-year, respectively. During the same period, China’s exports to Central Asia, the Middle East, Russia and other countries and regions performed well. Among them, China’s exports of knitted products to five countries in Central Asia increased by 45.41% year-on-year. Exports to Russia saw a 20.64% year-on-year increase, and exports to Turkey grew by 18.71% year-on-year. In addition, exports to Nigeria, Cameroon, Brazil and other countries also realized better growth.

Figure 3: Export Performance of China’s Knitted Products for Major Exports Destinations, 2023

Source: China Customs

Figure 4: Export Performance of China’s Knitted Products for Emerging Exports Destinations, 2023

Source: China Customs

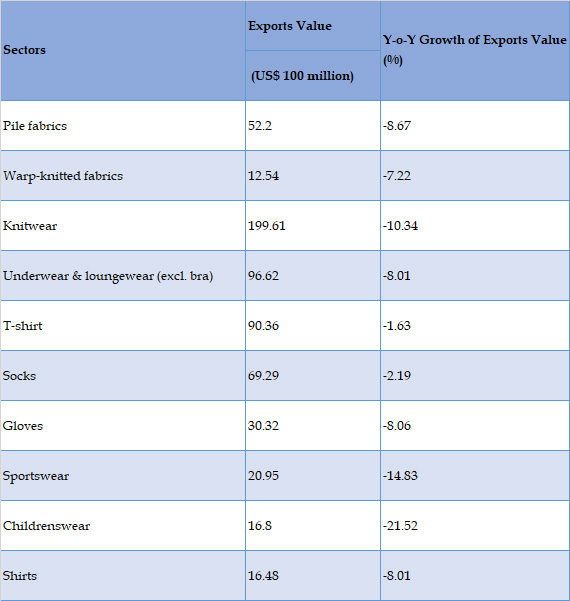

From the subcategory perspective, the decline in exports of T-shirts, socks, and other products was smaller last year. Relevant details are as follows:

Table 2: Exports of Knitted Products by Category in 2023

Source: China Customs

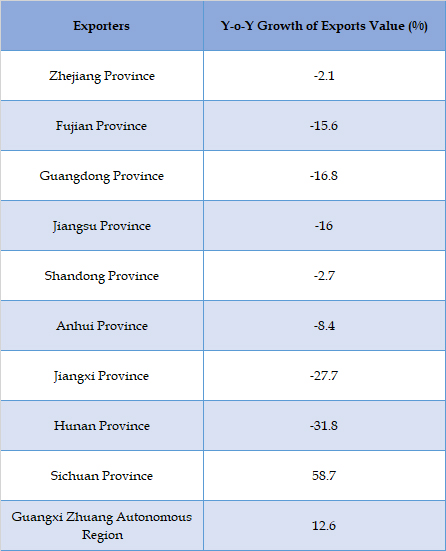

Local customs data from 2023 indicate that Xinjiang, Guangxi, Hubei, Sichuan, and other central and western provinces and cities had a faster growth in their exports. At present, the combined export value of the five eastern coastal provinces accounted for 75.24% of the total, while that of the central and western provinces and municipalities improved. The coordinated development in China has continued to improve. In the future, the Belt and Road Initiative and the establishment of the Xinjiang Free Trade Zone will create better opportunities for China's central, western, and northeastern regions.

Table 3: Knitted Products Exports of China’s Major Exporters in 2023

Source: China Customs

Source: CHINA TEXTILE LEADER Express

Authority in Charge: China National Textile and Apparel Council (CNTAC)

Sponsor: China Textile Information Center (CTIC)

ISSN 1003-3025 CN11-1714/TS

© 2026 China Textile Leader, all rights reserved.

Powered by SeekRay