2025/8/22

During the first half of 2025, external uncertainties grew significantly due to geopolitical tensions and ongoing U.S. tariff policies. Thanks to policies focused on boosting consumption and expanding domestic demand, along with efforts to diversify international markets, the overall performance of China’s knitting industry stayed stable, with exports slightly increasing and demonstrating industry resilience.

Operating Income

According to the National Bureau of Statistics, in the first half of 2025, the operating income of enterprises above the designated size in the knitting industry declined by 1.57% year-on-year. The growth rate decreased by 1.85 percentage points compared to the first five months and by 5.74 percentage points compared to the first quarter. Industry growth slowed from the second quarter onwards. Analyzing the two main product categories in the sector, knitted fabrics saw a 2.74% year-on-year decrease in operating income from January to June, while knitted garments experienced a 0.89% decline.

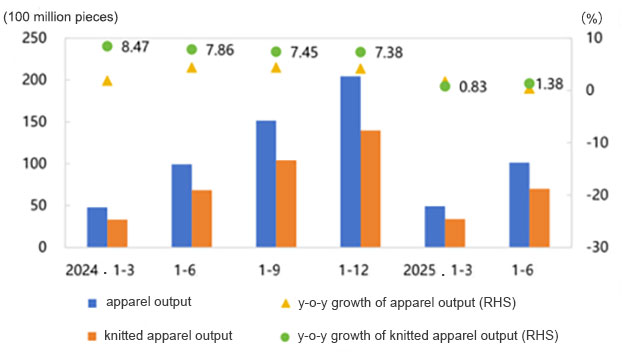

In the first half of 2025, the apparel output of enterprises above designated size in China’s textile and apparel industry increased by 0.4% year-on-year. Among them, knitted garment production grew by 1.38% year-on-year, 0.55 percentage points higher than in the first quarter. Knitted garment output made up 69.25% of total garment production, 0.24 percentage points more than the same period last year. Thanks to technological advances and the diversification of consumption scenarios in recent years, especially the rapid growth of yoga wear, sun suits, shirts, and suit jackets, the share of knitted apparel has continued to rise and is now at a historically high level.

Figure 1: The Output and Growth Rate of Clothing Produced by Enterprises above designated size in China’s Textile and Apparel Industry Since 2024

Source:National Bureau of Statistics

Operating Efficiency and Profit

In the first half, profits of enterprises above designated size in the knitting industry declined 11% year-on-year; the profit margin was 3.52%, down 0.37 percentage points compared to the same period last year. Two major sectors within the knitting industry showed differing efficiency performance: benefits from knitted fabrics maintained year-on-year growth, while knitted garments experienced a significant decline due to intensified market competition and export tariffs.

Table 1: The Main Economic Indicators of Knitted Enterprises Above Designated Size in 2024

Source: National Bureau of Statistics

Exports

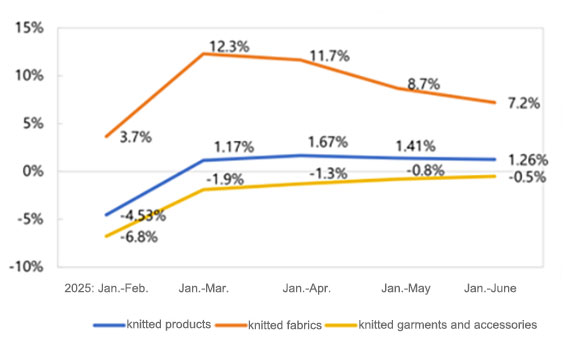

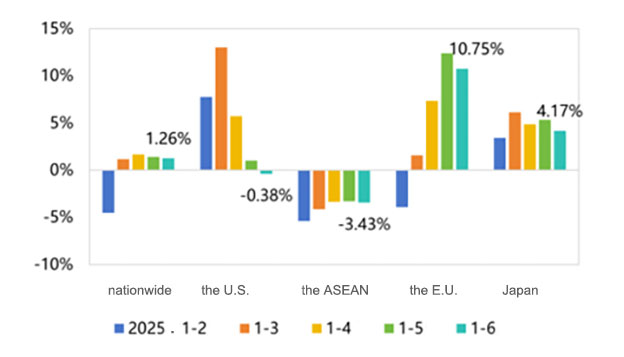

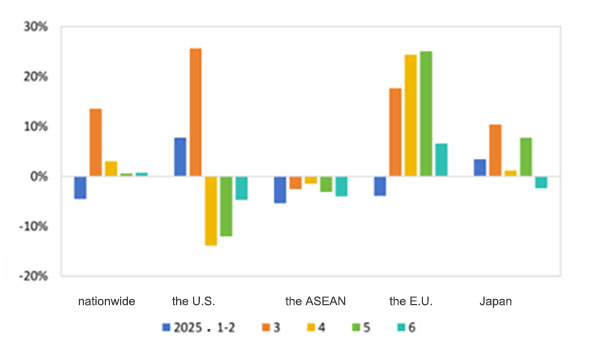

In the first half of the year, China exported US$50.85 billion worth of knitted products. Affected by the U.S. tariff policy, China’s exports to the United States fluctuated sharply, but those to the European Union and Japan showed resilient performance. Driven by diversified market strategy, the exports to Central Asia, South America and other emerging markets saw a 1.26% year-on-year growth. Among them, knitted fabric exports reached US$12.35 billion, seeing an increase of 7.2% year-on-year; knitted apparel and accessories exports totaled US$38.5 billion, down by 0.5% year-on-year, 1.4 percentage points narrower than the first quarter. In the first half of the year, China’s knitted fabrics exports to Bangladesh, Cambodia and other countries saw relatively high growth rates, and began to fall in the second quarter due to the impact of U.S. tariff policy.

Figure 2: Y-o-Y Growth Rate of China’s Knitted Products by Value in H1, 2025

Source: China Customs

Figure 3: Year-to-Date Export Growth of China’s Knitted Products

Source: China Customs

Figure 4: Monthly Export Growth Rate of China’s Knitted Products in 2025

Source: China Customs

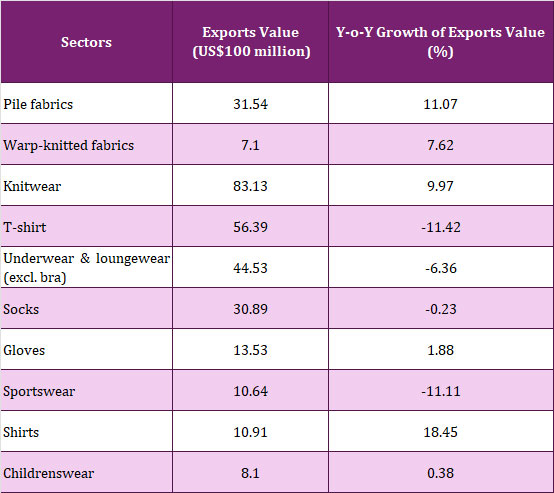

From the perspective of subcategories, from January to June, the export performance of pile fabrics, knitwear, and knitted shirts has been good, while exports of T-shirts and sportswear declined 11.42% and 11.11%, respectively, due to the high base in the same period last year.

Table 2: Exports of Knitted Products by Category in H1, 2025

Source: China Customs

From the point of view of local customs data, among the top five export sources of Chinses knitted products, Zhejiang Province, Jiangsu Province, and Shandong Province perform well in the first half of this year.

Table 3: Knitted Products Exports of China’s Major Exporters in H1, 2025

Source: China Customs

Future Prospect for the Second Half of 2025

Currently, industry development still faces a more complex external environment. Rising uncertainty in world trade policies and multi-dimensional changes are reshaping the global industrial landscape. Export uncertainties have increased, and with a lack of internal momentum in the domestic market, businesses continue to encounter many difficulties.

Regarding domestic sales, consumption remains insufficient, and the market potential has not yet been fully unlocked. However, the gradual rollout of various national policies aimed at stimulating consumption will help boost domestic sales of knitted products to some extent. Additionally, certain specialized knitted products, such as functional sports knitted apparel, align with current national health and fitness trends; there is still growth potential in niche markets.

Regarding foreign trade, the global economic growth rate remains low, and increasing trade policy uncertainty has significantly impacted the normal operation of international trade. Additionally, developed countries are promoting a diversification strategy in procurement, which drives the international industrial chain to become more vertically integrated and decentralized. This trend adds long-term uncertainty to China’s foreign trade environment. Despite numerous uncertainties in the external environment, China’s knitting industry still holds substantial advantages over other manufacturing countries, including a complete supply chain, flexible manufacturing capacity, and high standards of production quality management, especially in digitalization and intelligent technologies. While developing traditional markets, China’s knitting industry should quicken the pace of diversifying into international markets and leverage the positive influence of cross-border e-commerce.

Source: CHINA TEXTILE LEADER Express

Authority in Charge: China National Textile and Apparel Council (CNTAC)

Sponsor: China Textile Information Center (CTIC)

ISSN 1003-3025 CN11-1714/TS

© 2026 China Textile Leader, all rights reserved.

Powered by SeekRay