2025/8/22

I. Performance in the H1

(I) Output

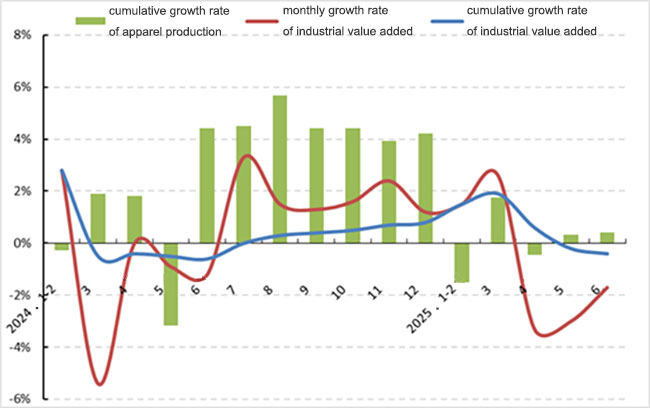

In the first half of the year, benefiting from increased consumer demand in the domestic market and sustained rapid growth in clothing exports, apparel production saw year-on-year growth. According to the National Bureau of Statistics, from January to June, the industrial added value of enterprises above designated size in the apparel industry decreased by 0.4% compared to the same period in 2024, which is 0.2 percentage points narrower than the decline in 2024; and their apparel output grew by 0.4% year-on-year, 4.02 percentage points slower than the same period in 2024. In terms of subcategories, with rising demand for sports, outdoor, and functional leisure apparel, the output of knitted apparel maintained faster growth, and its share of total apparel production continued to increase. From January to June, the output of knitted apparel from enterprises above designated size rose by 1.38% year-on-year, making up 69.25% of total production; woven apparel output declined by 1.72%, while down apparel output increased by 4.28%. The production of suits and shirts decreased by 8.61% and 2.71%, respectively.

Figure 1: The Growth Rate of China’s Apparel Industry Production in H1, 2025

Source: National Bureau of Statistics

(II) Domestic sales

In the first half of the year, with the national special action to boost consumption progressing steadily and holiday spending along with increasingly promotional activities, China’s residents continue to grow their demand for clothes. The market supply keeps improving, and domestic clothing sales see moderate growth. According to the National Bureau of Statistics, from January to June, China’s retail sales of apparel above designated size totaled 534.13 billion yuan, seeing an increase of 2.5% year-on-year. Live e-commerce and other channels continue to boost consumption. Combined with “618” promotional events, online sales growth has steadily resumed. In the first half, online retail sales of apparel grew by 1.4% year-on-year, which is 1.5 percentage points higher than in the first quarter.

(III) Exports

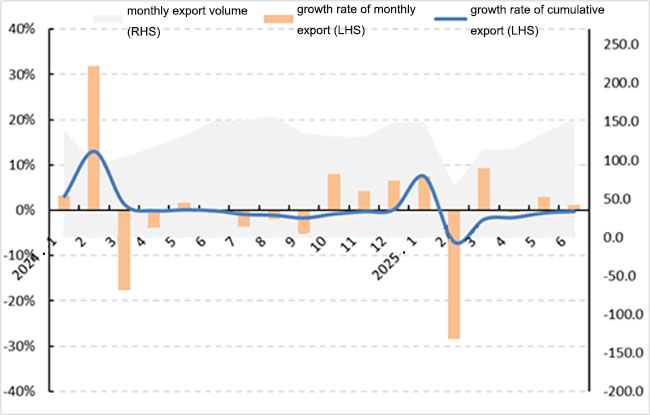

This year, despite weak international market demand and intensified supply chain risks, China’s apparel exports show more volatility. With the United States’ tariff policies lifted, the rate of decline in exports gradually narrowed. According to China Customs data, from January to June, China’s apparel and accessories exports totaled US$73.46 billion, reflecting a 0.2% year-on-year decline, 0.2 percentage points lower than the same period in 2024. From a monthly perspective, the Spring Festival caused fluctuations in the first two months; in March, driven by tariff expectations and a low base from the previous year, apparel exports surged by 9.3% year-on-year. In May and June, relying on the “window period” for U.S. tariff suspension to expedite order processing, apparel exports increased by 3.0% and 1.1% year-on-year, respectively.

Figure 2: The Performance of China’s Apparel and Accessories Exports in H1, 2025

Source: China Customs

From the perspective of subcategories, exports of higher value-added commuting and social apparel continued to grow, with the export value of casual suits, pants, and shirts increasing by 17.1%, 6.2%, and 0.7% year-on-year, respectively. The export volume of suits and T-shirts increased, while prices declined, with export unit prices dropping by 12.5% and 13.3% year-on-year, respectively. Exports of men’s and women’s bathrobes and down jackets decreased in volume, but prices rose; export unit prices increased by 23.5% and 14.5% year-on-year, respectively.

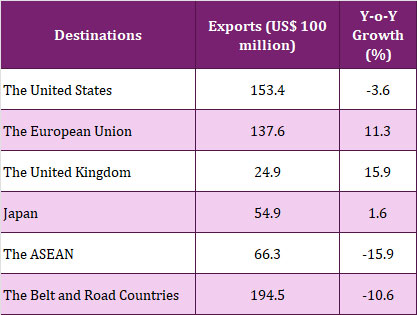

From the perspective of the major market, the export market witnessed an obvious diversification trend.

Table 1: China’s Apparel Exports by Destinations in H1, 2025

Source: China Customs

As for the exporting provinces, the main concentration area of China’s apparel exports remained the eastern region; the central and western regions showed varied performance.

Table 2: Apparel Exports Performance of China’s Major Exporters in H1, 2025

Source: China Customs

(IV) Investment

In the first half of the year, supported by policies, apparel enterprises have actively increased their investments in transformation and upgrading to improve infrastructure and renew equipment. Industry investment in fixed assets has continued to grow at a faster rate since 2024. According to the National Bureau of Statistics, from January to June, the actual investment completed in the apparel industry surged by 27.0% year-on-year, with the growth rate accelerating by 13.0 percentage points compared to the same period in 2024. This increase outpaced the manufacturing industry and the textile industry by 19.5 and 12.5 percentage points, respectively.

Figure 3: Y-o-Y Growth of Fixed-asset Investment in China’s Textile Industry in H1, 2025

Source: National Bureau of Statistics

(V) Benefits

This year, due to reduced demand, rising costs, and other factors, competition in both domestic and international markets has intensified. It is challenging to increase product prices. As a result, the garment industry’s revenue is shrinking, and profit margins are heavily compressed. According to the National Bureau of Statistics, from January to June, the operating income of enterprises above designated size in China’s apparel industry totaled 564.88 billion yuan, a 1.43% decline year-on-year; total profit reached 20.92 billion yuan, down 12.92% from last year; and the operating income margin was 3.70%, 0.49 percentage points lower than the same period last year. The turnover rate of finished products was 9.74 times/year, declining by 3.51% year-on-year; the turnover of accounts receivable was 5.99 times/year, seeing a year-on-year decrease of 6.62%; and the total asset turnover was 1.09 times/year, down by 3.73% year-on-year.

Figure 4: Main Economic Indicators of China’s Apparel Industry in H1, 2025

Source: National Bureau of Statistics

II. Characteristics of the Development of the Apparel Industry in H1, 2025

(I) Private Domain Marketing Maintains Upgrading

Private domain marketing has expanded from WeChat-based commerce to multiple channels, such as WeChat subscriptions, programs, and live broadcasts. As a new channel for users, private domain marketing plays a crucial role in expressing brand value, co-creating products, and integrating omni-channel strategies, becoming a key driver of growth in branded apparel e-commerce. Companies build consumer communities around their brands, sharing previews of new products, styling tips, fashion updates, and other content, while promptly responding to user inquiries and collecting feedback. Frequent interactions between the brand and users foster a strong brand community, strengthen users’ sense of identity and loyalty, and significantly boost user retention and repurchase rates.

(II) The Outdoor Sports Apparel Category Has Become a Consumption Highlight

Driven by the trend of youthful and personalized consumption, health has become a primary demand for residents, and their willingness to exercise continues to grow, fueling the rapid expansion of the new outdoor sports market. Li-Ning introduced fitness suits, leggings, and other women’s products to meet multi-scene clothing needs for activities like yoga, Pilates, and gym workouts; 361° launched the “super store program”, opening 49 immersive experience stores in key cities by the first half of the year, with significant improvements in the performance of each store. While taking advantage of consumption upgrades, companies actively pursue technological innovation and product upgrades. Anta keeps investing in sports technology to cover a range of activities like running and basketball; Camel, Pelliot, and Kailas advance their water-repellent, skin-friendly fabric technologies, achieving continuous innovation and upgrades in waterproofing, breathability, quick-drying properties, and other key features, to meet the personalized needs of consumers at all levels.

(III) AI Technology Empowers Industry Development

Artificial intelligence technology has deeply integrated into the apparel industry, speeding up the development of intelligence in creative design, trend prediction, smart dressing recommendations, and production and manufacturing. This creates more possibilities for apparel design, production, and consumption. On one hand, the AI system optimizes the production process and increases its accuracy, ensuring product consistency while enabling flexible small-batch production that accurately meets personalized consumer demand. Hubei Tianmen’s garment industry has established an “on-demand manufacturing” fast response system through AI design, intelligent hanging, and digital twins, enabling timely analysis of global order demand, reducing order delivery cycles from 3 days to 4 hours, and becoming a benchmark for digital intelligent flexible manufacturing. On the other hand, the “AI+Marketing” solution allows for precise targeting by automatically generating visual product materials and integrating them with user profiles, significantly improving marketing efficiency and conversion rates.

Source: CHINA TEXTILE LEADER Express

Authority in Charge: China National Textile and Apparel Council (CNTAC)

Sponsor: China Textile Information Center (CTIC)

ISSN 1003-3025 CN11-1714/TS

© 2026 China Textile Leader, all rights reserved.

Powered by SeekRay