2021/4/14

Driven by the global demand for anti-epidemic materials, the production, sales, exports and investment of China's technical textile industry have seen a surge in 2020. And its economic benefits improved significantly. In 2021, the production capacity of the new investment in the technical textile industry will be gradually released. The demand for anti-epidemic materials will return to normal. It will take time for the global market to recover under the Covid-19 pandemic, and the development of the industry will face more uncertainties and risk factors in 2021. Under this backdrop, China Nonwovens & Industrial Textile Association (CNITA) conducted spring online surveys, so as to resolve the potential risks in the industry timely, and provide targeted consulting suggestions for enterprises, industries and government departments.

Analysis of interviewed enterprises

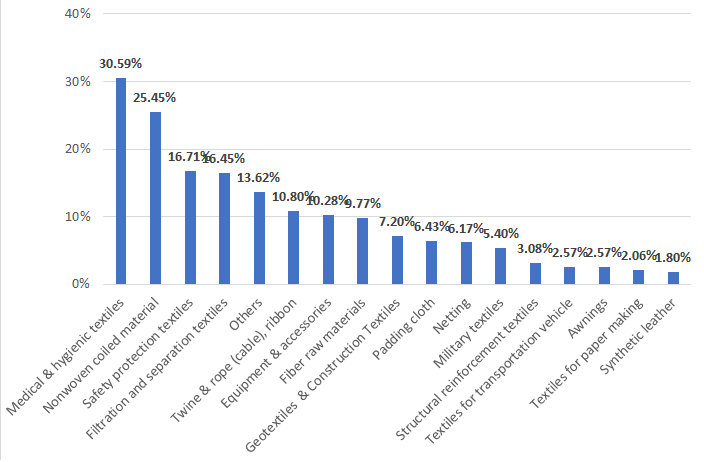

By region, the surveyed companies are mainly located in Jiangsu Province, Zhejiang Province and Shandong Province, accounting for 63.24% of the total. In addition, there are more than 10 surveyed companies in Guangdong Province, Hubei Province, Hebei Province and Fujian Province, basically cover China's main production area of technical textiles. From the perspective of industry distribution, the surveyed companies come from the fields of medical and hygiene textiles, nonwoven coiled material, safety protection textiles, filtration and separation textiles, fibers and equipment. Among the surveyed companies, 23.2% of the companies are engaged in the production of surgical masks, 12.85% of the companies are engaged in the production of protective clothing, 6.43% of the companies are producing disinfectant wipes, and 66.24% of the companies are not engaged in the production of epidemic prevention materials.

Figure 1: Distribution of surveyed companies by field

In terms of scale, 12.08% of surveyed companies have annual sales revenue of more than CNY 1 billion, 7.46% of companies have sales revenue of between CNY 500 million and CNY 1 billion, and 33.68% of companies have annual sales of between CNY 100 million and CNY 500 million. In addition, 9.51% of enterprises have annual sales revenue of less than CNY 20 million. Therefore, the geographical, industry, and scale distribution of the surveyed companies have strong rationality.

Business review in 2020

As for the business operations in 2020, 60% of the surveyed companies said that their operating income and profits have increased to varying degrees. Among them, 20% of the companies said that the growth rate exceeded 50%, and nearly 30% of the companies said that the growth rate exceeded 10% but less than 50%;20% of the companies said the above two indicators were basically at the same level; the remaining 20% of the companies said that their income and profits had declined to varying degrees, of which about 7% of the companies said that the decline was more than 20%.

Industry operation from January to February 2021

As for the continued demand for epidemic prevention materials in the first two months this year, the overall operation of the technical textile industry will be better than the same period in previous years. The surveyed companies were highly satisfied with the operating conditions of the first two months. Among them, 13.4% of the companies believed that the current operating conditions were very good; more than half of the companies reckoned that the business situation was relatively good, and nearly one third of the companies thought that the business situation was fair.

Many localities have introduced initiatives, policies, and measures to encourage people to stay in their current place of residence during the Spring Festival holiday. The resumption of work and production in 2021 was significantly better than in previous years. As of the end of February, nearly three-quarters of the surveyed companies indicated that almost all workers had back to work. 38.92% of the surveyed companies have been fully productive; 34.28% of the companies have recovered 80% of their production capacity.

Since 2021, the prices of main raw materials have entered an upward channel. The raw material price index reached 81. 70% of the companies surveyed said that the prices of raw materials have risen to vary degrees, and nearly 30% of the companies said the price rise was more than 10%. The labor cost of enterprises has continued the upward trend over the years, with a labor cost index of 74. The increase in raw material costs and labor costs has led to a rise in the prices of companies' products to varying degrees. The price index of finished products of enterprises was 63, which was lower than the index of raw material prices and labor costs.

The impact of overseas markets on the technical textile industry

In this survey, the surveyed companies scored the company's dependence on overseas markets. A score of 0 means low dependency and a score of 10 means high dependency. The average score was 4.1, which is in the low range. By industries, the following industries have a low degree of dependence on overseas markets, including filtration, textiles for vehicles, geotextiles, textiles for paper making, special textiles. While the medical & hygienic textiles, safety protection textiles, twine & rope (cable), ribbon have a relatively high dependence on overseas markets, but their scores are all lower than 6.

It is worthwhile noticing that China's exports of masks, protective clothing, and isolation clothing in 2020 exceed US$ 60 billion. Especially after May 2020, the proportion of overseas orders was very high. Therefore, the operations of these companies were vulnerable to the changes in demand for overseas epidemic prevention materials.

Full year forecast of 2021

Regarding the development of the whole year in 2021, the confidence index of the surveyed companies reached 71. 67.78% of the companies expressed optimism about the development of the whole year. In terms of different fields, companies in the fields of geotextiles, safety protection, structural reinforcement, filtration and separation, netting, textiles for papermaking, and special textiles are more optimistic about this year's development. After the rapid growth in 2020, medical and hygiene textiles and nonwovens companies showed more caution about this year's forecast in the face of the slowdown in the demand for epidemic prevention materials.

From the perspective of enterprise scale, large enterprises are more optimistic about the development of 2021. Enterprises above designated size with annual sales revenue of less than CNY 100 million are pessimistic about the situation for the whole year.

The confidence of enterprises is also reflected in the investment willingness in fixed assets. 63.66% of the surveyed companies indicated that they have new investment plans in 2021. The planned investment projects are mainly focused on capacity expansion, upgrading of existing equipment, and establishing new plants.

Regarding the current difficulties faced by enterprises in their business operations, labor shortages, difficulties in overseas market expansion and declining market demand are the three most selected by enterprises. In addition, difficulties in purchasing raw materials and financial constraints are also issues that enterprises have reported more frequently.

Regarding the external challenges faced by companies, the problems reported by companies are mainly concentrated in the large fluctuations in raw material prices and the excessive production capacity of the industry. Difficulties in recruiting labor, changes in the RMB exchange rate, and declining demand for epidemic prevention materials are also issues that companies have reported more.

In the face of a complicated environment and fierce competition, the competitive advantages of the surveyed companies are mainly focused on innovation capabilities, customer relationships, product quality, and management teams. About 20% of the companies believe that their company is in a potential development field and has a cost advantage.

Conclusion and suggestion

On the whole, the technical textile companies participating in this survey are satisfied with the operating conditions in the first two months of 2021 and have high confidence in the operating conditions for the whole year.

Due to the global loose monetary policy, and optimistic expectations in the post-epidemic era, raw material prices will rise sharply in 2021. The short-term fluctuations in the price of raw materials will cause problems for the operation of enterprises, but in the long-term, the entire industry chain will share the pressure of rising prices.

At present, some meltblown nonwovens and mask production lines have already withdrawn from the market. As the epidemic situation further eases, more of this type of production capacity will choose to withdraw. The new spunbond and spunlace nonwoven production capacity will be gradually released in the next two years. The technical textile industry needs to continuously expand new markets and new applications to reduce the impact of the large-scale capacity increase on the industry.

Technical textiles are a technology-oriented industry. And the product performance, quality, and cost advantages formed through technological innovation are the key to enterprises winning in the fierce market competition. Enterprises need to strengthen technological innovation and professional talent training, vigorously promote the upgrading of intelligent manufacturing and green manufacturing, make up for the shortcomings of the industry, promote the upgrading of industrial formats, and enhance the independent controllability of the supply chain.

Source: CHINA TEXTILE LEADER Express

Authority in Charge: China National Textile and Apparel Council (CNTAC)

Sponsor: China Textile Information Center (CTIC)

ISSN 1003-3025 CN11-1714/TS

© 2025 China Textile Leader, all rights reserved.

Powered by SeekRay