2025/12/22

Since the beginning of 2025, China’s apparel industry has faced severe economic pressures amid complex and volatile external conditions. Key indicators such as production, exports, and profitability have fallen sharply, investment growth has slowed, while domestic sales have maintained moderate growth. Looking ahead, the ongoing implementation of national policies to boost consumption will continue to produce results. Year-end shopping occasions, such as Christmas and New Year’s Day, will boost demand, creating opportunities and laying the groundwork for the industry’s economic recovery. However, overall momentum for consumption improvement remains weak both domestically and internationally. Various unstable factors, including geopolitical conflicts and trade frictions, still exist, and the industry continues to face significant challenges in achieving high-quality development.

I. Economic Performance of the Apparel Industry in the First Three Quarters

(A) Output

During the first three quarters, China’s apparel industry experienced a decline in production, with the industrial added value of enterprises above the designated size also declining. The slowdown in apparel exports during the third quarter mainly affected the industry, causing apparel output to shift from slight growth in the first half to a slight decline. According to data from the National Bureau of Statistics, from January to September, the industrial added value of enterprises above the designated size in the apparel sector fell by 2.4% year-on-year, with the growth rate decreasing by 2.8 percentage points compared to the same period in 2024. Output from these enterprises dropped by 1.47%, with the growth rate slowing by 1.07 percentage points from the first half and decreasing by 5.88 percentage points compared to the same period in 2024. In product categories, woven apparel production declined more sharply than knitted apparel. Data show that from January to September, enterprises above the designated size’s woven apparel output fell 4.24% year-on-year. Within this category, down apparel production increased by 6.21%, while suit and shirt production declined by 16.18% and 4.87%, respectively. Knitwear production decreased slightly by 0.2%. Meanwhile, driven by increased demand for sportswear, outdoor apparel, and functional casual wear, the share of knitwear in total garment production continued to grow, reaching 69.39%—an increase of 0.57 percentage points compared to the same period in 2024.

Figure 1: The Growth Rate of China’s Apparel Industry Production in Jan.-Sept., 2025

Source: National Bureau of Statistics

(B) Domestic sales

Since the start of this year, supported by positive factors like the effectiveness of national policies to boost consumption and the gradual recovery of consumer confidence, the domestic apparel market has experienced moderate growth, with online retail channels showing an improving trend. According to data from the National Bureau of Statistics, from January to September, the total retail sales of apparel goods by enterprises above designated size reached 759.02 billion yuan, a 2.4% increase year-on-year. This growth rate was 2.6 percentage points higher than the same period in 2024. Business models such as live-streaming sales and social e-commerce continued to boost consumption, with online retail sales of apparel products rising by 2.8% year-on-year—an increase of 1.4 percentage points compared to the first half of this year.

(C) Exports

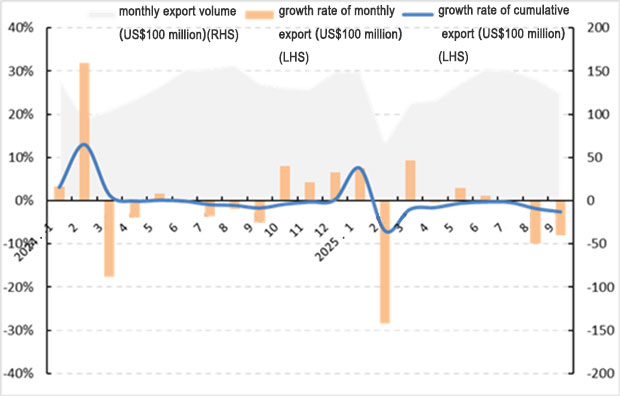

In the first three quarters, China’s apparel exports continued to decline due to weak international demand and changes in U.S. tariff policies. According to China Customs data, during this period, China’s total export value of garments and clothing accessories reached US$115.21 billion, a 2.5% decrease compared to the previous year. In terms of volume and price, garment exports kept increasing in volume but saw falling prices. Export volume reached 26.75 billion pieces, up 5.9% year-on-year, while the average export price dropped 7.5% to US$3.6 per piece. Monthly data show clothing exports grew in the first half of the year but entered a period of sustained negative growth in the third quarter. July exports declined 0.3% year-on-year, with August and September seeing decreases of 10.0% and 8.0%, respectively. The growth rate of export volume also slowed from 8.7% in the first half to 1.3% in the third quarter.

Figure 2: The Performance of China’s Apparel and Accessories Exports in Jan.-Sept., 2025

Source: China Customs

By export category, knitwear exports totaled US$51.64 billion, down 2.3% year-on-year, with export volume increasing by 5.5% and export unit price decreasing by 7.4%. Woven apparel exports reached US$43.57 billion, down 1.8% year-on-year, with export volume rising 6.9% and export unit price falling 8.2%. Within subcategories, exports of higher value-added commuter and social wear showed steady growth. Specifically, exports of casual suits, pants, and sweaters increased by 17.5%, 3.1%, and 3.0%, respectively, year-on-year. Exports of tops and T-shirts experienced volume growth but price declines, with export unit prices falling 16.3% and 12.0% year-on-year, respectively. Down jackets saw a decrease in volume but an increase in prices, with export unit prices rising 10.4% year-on-year.

Looking at major markets, apparel exports demonstrated a clear pattern of diversification. China’s apparel exports to the United States fell sharply, while exports to the EU, Japan, the UK, and other markets continued to grow rapidly, effectively compensating for the loss of market share in the US. During this period, fluctuating U.S. tariff policies hampered efforts to adapt corporate export strategies. China’s exports to ASEAN and Belt and Road countries and regions further declined. Meanwhile, apparel companies actively promoted market structure optimization and diversification, leading to strong growth in exports to Latin America, Africa, Chile, Canada, and other trading partners.

From the exporting province’s perspective, the eastern regions remained the main center for China’s apparel exports, with Zhejiang Province and Shandong Province showing continued growth. In contrast, provinces in the central and western areas displayed significant variation in export performance. Hubei and Guangxi experienced notable growth, while Sichuan and Hunan faced double-digit declines. According to China Customs data, from January to September, the eastern region’s apparel exports totaled US$93.49 billion, declining by 1.9% year-on-year, making up 81.2% of the country’s total apparel exports. Among the top five apparel exporting provinces, Zhejiang and Shandong saw year-on-year increases of 4.8% and 4.1%, respectively; Guangdong, Jiangsu, and Xinjiang experienced decreases of 10.3%, 2.7%, and 7.2%, respectively. During the same period, apparel exports from central and western regions reached US$21.72 billion, dropping 4.8% year-on-year. Hubei and Guangxi recorded growth of 6.2% and 10.6%, respectively, while Jiangxi grew by 1.5%. Sichuan and Hunan faced declines of 41.4% and 24.9%, respectively.

(D) Investment

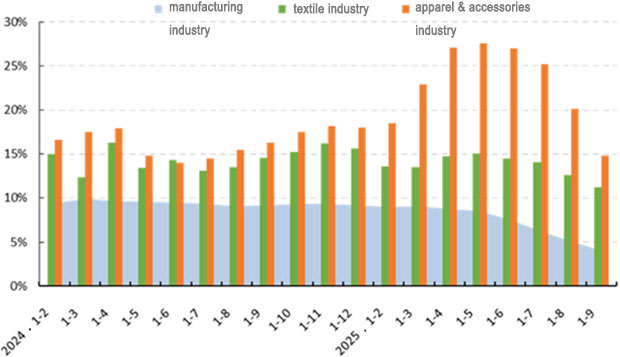

The new initiatives announced aim to boost private sector involvement in major national projects and programs, including those aligned with key national strategies. These efforts focus on enhancing security capacity in critical areas and on the large-scale renewal of equipment and trade-ins of consumer goods. This year, clothing companies have accelerated their transformation toward high-end, smart, and eco-friendly development. They have increased investments in areas such as technological upgrades, brand development, and expanding sales channels. Although the growth rate of fixed-asset investment in the industry has slowed slightly, it has continued the relatively fast growth trend seen since 2024. According to data from the National Bureau of Statistics, actual investment in the apparel sector from January to September rose by 14.8% year-on-year. While this growth rate slowed by 1.5 percentage points compared to the same period in 2024, it still exceeded the growth rates in the manufacturing and textile industries by 10.8 and 3.6 percentage points, respectively.

Figure 3: Y-o-Y Growth of Fixed-asset Investment in China’s Textile Industry in Jan.-Sept., 2025

Source: National Bureau of Statistics

(E) Benefits

During the first three quarters, China’s apparel industry faced significant challenges in operational quality and efficiency due to weak demand, intensifying competition, and rising costs. Revenue growth continued to slow, overall profits declined noticeably, and corporate profitability weakened. According to data from the National Bureau of Statistics, from January to September, China’s apparel industry included 13,673 enterprises above the designated size (with annual main business revenue of 20 million yuan or more), generating 868.52 billion yuan in operating revenue, which decreased by 4.63% year on year. This growth rate was 5.65 percentage points lower compared to the same period in 2024. Total profits fell to 31.92 billion yuan, down 16.19% year on year, with the decline widening by 13.57 percentage points compared to the same period in 2024. The operating income profit margin stood at 3.68%, 0.51 percentage points lower than in the same period of 2024.

The share of loss-making enterprises increased, and operational efficiency decreased. From January to September, the proportion of loss-making enterprises among apparel enterprises above the designated size was 27.21%, an increase of 2.48 percentage points compared to the same period in 2024. The ratio of selling, general, and administrative expenses (SG&A) was 9.75%, 0.16 percentage points higher than during the same period in 2024. The turnover rates for finished goods and accounts receivable were 9.64 times/year and 5.60 times/year, respectively, reflecting year-on-year decreases of 3.52% and 7.36%. The total asset turnover rate was 1.09 times/year, down 5.90% compared to the previous year.

II. Characteristics of the Development of the Apparel Industry in the First Three Quarters, 2025

Apparel Subcategories Unlock New Growth Potential

Driven by evolving consumer preferences and diverse demand, the apparel industry is entering a new phase of structural growth led by specialized subcategories. Sportswear and outdoor apparel, smart-look women’s wear, and pet clothing and accessories are particularly standout segments, emerging as new drivers of industry expansion. According to Douyin E-commerce’s “2025 Double 11 Sportswear Report”, sales of sports and outdoor apparel surged over 104% year-on-year during October's key promotional period. Domestic brands expanded their market share by leveraging “high cost-effectiveness + scenario-specific fit”. For example, Anta launches entry-level down jackets priced under 100 yuan for students, and Li-Ning develops hiking shoes tailored for outdoor activities—both precisely meeting consumer needs. According to QianGua Data’s “2025 Xiaohongshu High-Growth Sector Report”, the “smart-look Styling” topic drew over 78 million views on Xiaohongshu. Smart-look women’s wear emphasizes design aesthetics and feminine characteristics, fulfilling female consumers’ changing demand for fashion ex

Cross-Industry Collaboration Ignites Market Vitality

To meet the demands of new-quality productive forces, apparel brands are repositioning themselves within the industry by strengthening cross-industry development strategies. By blending art, culture, technology, and other fields, they are introducing innovative design concepts and functionalities to clothing. This approach fulfills consumers’ desire for personalization and uniqueness, continuously boosting brand vitality and influence. For example, Hongdou Group teamed up with China Mobile and six other innovative companies to establish the “AI+ Apparel New Retail Experience Center”. This initiative incorporates advanced technologies like AI shopping assistants, AR virtual fitting rooms, and 3D intelligent body measurement, creating a closed-loop ecosystem of “intelligent service – data-driven operations – flexible production”. This has improved market service capabilities and standards while further stimulating market vitality.

A New Paradigm for Accelerating Healthy Apparel Consumption

Driven by new lifestyles and material innovations, health-conscious consumption has evolved from a luxury option to an essential requirement for quality living. Health considerations are increasingly prominent in the apparel industry, becoming a key development direction and value focus. On one hand, apparel companies are integrating biotechnology, smart sensors, and eco-friendly materials into product development. On the other hand, apparel brands are strengthening health-focused marketing by creating scenario-based solutions—such as “exercise + social interaction” and “sleep + wellness”—to integrate health concepts into consumers’ daily lives, transitioning from product sales to lifestyle leadership.

Source: CHINA TEXTILE LEADER Express

Authority in Charge: China National Textile and Apparel Council (CNTAC)

Sponsor: China Textile Information Center (CTIC)

ISSN 1003-3025 CN11-1714/TS

© 2026 China Textile Leader, all rights reserved.

Powered by SeekRay