2024/5/24

In the first quarter of 2024, demand is increasing steadily, market confidence is growing, and high-quality development has yielded new results. In this context, China's chemical fiber industry experienced faster production growth, stable market price fluctuations, year-on-year revenue growth, and better profits compared to the same period in 2023. However, the recovery of downstream demand was hindered by rain and snow, leading to a gradual buildup of chemical fiber inventories. In addition, chemical fiber exports decreased year-on-year due to trade barriers and geopolitical conflicts.

I. Production & Sales

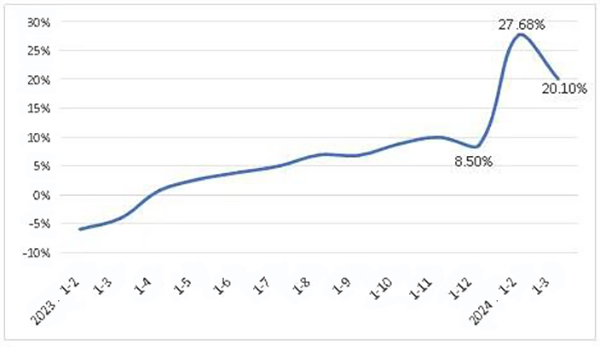

According to the National Bureau of Statistics, the output of chemical fibers in the first quarter totaled 18.54 million tons, up by 20.1% year-on-year. Such a significant increase in growth rate is mainly attributed to the low starting point in the same period of 2023. As the base improves, the growth rate will gradually decrease. In the first three months, the growth rate of chemical fiber production has already decreased by 7.58 percentage points compared to the January-February period (Figure 1).

Figure 1: The Output of Chemical Fibers from the Beginning of 2023

Source: National Bureau of Statistics, China Chemical Fibers Association (CCFA)

In the first quarter, the inventory of the chemical fiber industry decreased initially and then increased. The inventory continued to decline in the fourth quarter of 2023 before the Spring Festival. After the Spring Festival holiday, rainy and snowy weather caused a sluggish recovery in downstream demand. In addition, as the industry’s initial workload increases, the stock of key chemical fiber products is also growing steadily. In late March, as the demand downstream increases, the pressure on the chemical fiber inventory has eased. As of April 12, the average inventory for polyester POY, polyester staple, nylon, and spandex was approximately 26 days, 14 days, 15 days, and 44 days, respectively.

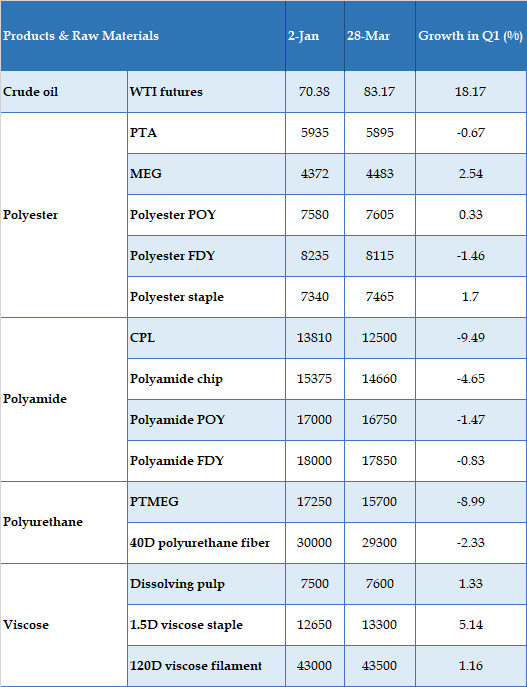

II. Market & Price

Table 1: Price Change of Main Chemical Fibers and Raw Materials

Unit: US$, CNY

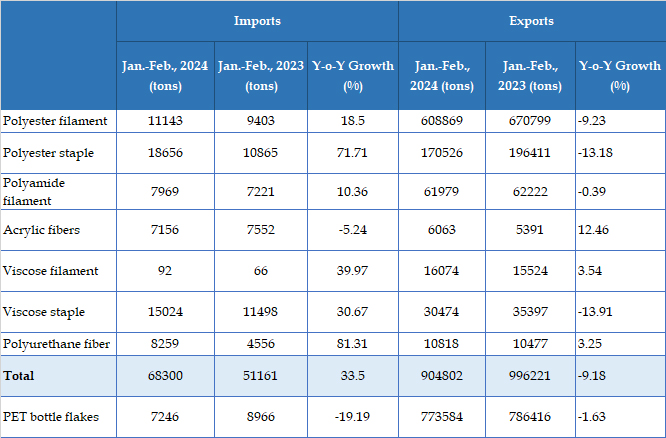

III. Foreign Trade

According to China Customs data, the exports of major chemical fiber products decreased by 9.18% year-on-year in the January-February period, which is 24 percentage points lower than the annual growth rate in 2023. By products, exports of polyester filament, polyester staple, and viscose staple fell significantly year-on-year, while acrylic fibers and spandex saw a year-on-year increase. Among them, polyester filament exports fell more due to the Spring Festival holiday, trade barriers, geopolitical conflicts and other impacts.

Table 2: Foreign Trade of Chemical Fiber Products in First Two Months of 2024

Source: Based on data from China Customs

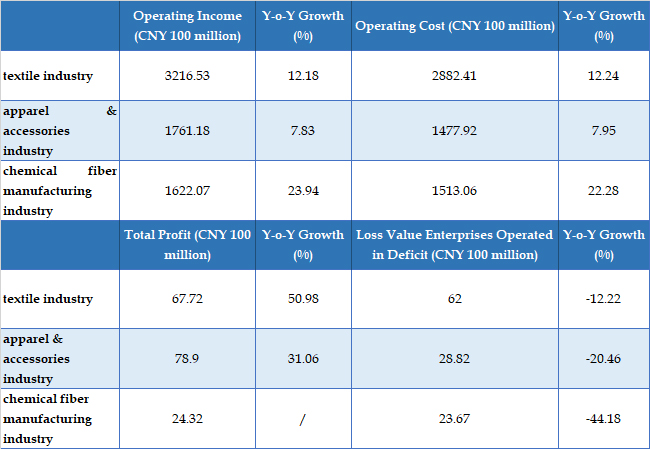

IV. Revenue & Benefits

Table 3: Economic Benefit of Chemical Fiber and Related Industries in Jan.-Feb. 2024

Source: National Bureau of Statistics

V. Fixed-assets Investment

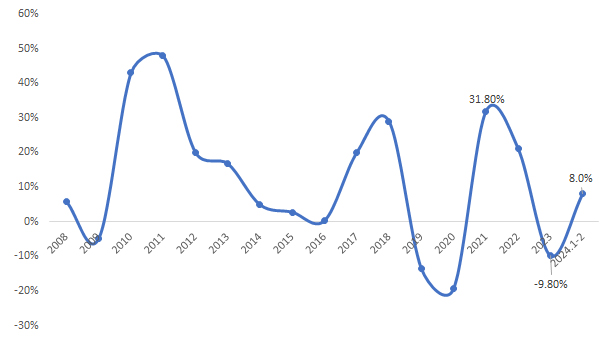

The National Bureau of Statistics data shows that fixed-asset investment in the chemical fiber industry increased by 8.0% year-on-year in the first two months of 2024. Fixed asset investment increased due to the low-base effect. From the viewpoint of new production capacity, the capacity of polyester filament has decreased notably, while the capacity of PET bottle flakes is still expanding.

Figure 2: Fixed-Assets Investment Growth of the Chemical Fiber Industry from 2008 to Feb. 2024

Source: National Bureau of Statistics

Source: CHINA TEXTILE LEADER Express

Authority in Charge: China National Textile and Apparel Council (CNTAC)

Sponsor: China Textile Information Center (CTIC)

ISSN 1003-3025 CN11-1714/TS

© 2026 China Textile Leader, all rights reserved.

Powered by SeekRay