2021/5/27

In 2020, the Sino-US economic and trade frictions and the Covid-19 pandemic have wreaked havoc on China's economy. By ensuring stability on the six fronts and security in the six areas, China has basically consolidated the foundation for economic recovery. The national economy was generally stable, and consumption and investment picked up continually. The industry market of China's textile machinery industry is showing a gradual recovery, but its main economic indicators were still in the falling range. Its decline has gradually narrowed. Driven by the epidemic prevention related equipment, the exports have increased significantly. At present, the global textile machinery market has not yet completely recovered from the impact of the epidemic, and the overall production and operation of China's textile machinery industry are still facing greater pressure.

I. Economic operation

1. Industry scale

In 2020, enterprises above designated size in the textile machinery industry earned CNY 73.07 billion of prime business income, down 6.77% year-on-year, declining 0.23 percentage points compared with same period of last year. It had more than CNY 105.2 billion of total assets, up 10.17% year-on-year. Since the resumption of work and production in the second quarter, the decline in industry operating income has gradually narrowed, and the decline in annual operating income has narrowed by 9.27 percentage points compared with the previous three quarters of 2020. In the fourth quarter, operations improved significantly, and the quarterly increase in operating income rose sharply from the previous quarter, reaching 17.65%.

2. Structure of costs and expenses

In 2020, the costs of the textile machinery totaled more than CNY 66.07 billion, down 7.66% year-on-year, in which, prime operating costs stood at about CNY 58.96 billion, decreased by 7.84% year-on-year, covering 89.23% of the total. The share of three overheads in turnover reached 10.77%, up by 0.18 percentage point. Thereinto, sales expenses amounted to more than CNY 2.42 billion, declined by 11.19%, accounting for 3.67% of the total; management expenses stood at over CNY 4.08 billion, down 5.57%, accounting for 6.18% of the total; financial expenses totaled CNY 611 million, up 15.57%, accounting for 0.92% of the total.

3. Profit

In 2020, the textile machinery industry earned more than CNY 5.54 billion of profits, down 3.73% year-on-year, 22.60 percentage points narrower than that of the first three quarters of 2020. 21.43% of enterprises operated in red, and their deficit totaled CNY 541 million, surged by 53.69% year-on-year. In 2020, the profit margin of the main business of the textile machinery industry was 7.59%, seeing a year-on-year decline of 0.33 percentage points.

II. Import and Export

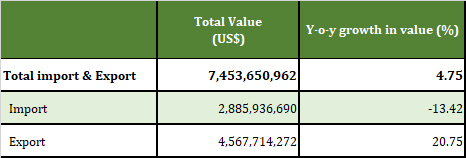

According to the General Administration of the Customs, China's import and export of textile machinery totaled more than US$ 7.45 billion in 2020, up 4.75% year-on-year. The import of textile machinery totaled over US$ 2.88 billion, down 13.42% year-on-year, while the export stood at US$ 4.56 billion, up 20.75%.

Table 1: Import and Export of Textile Machinery in January-December 2020

1. Import

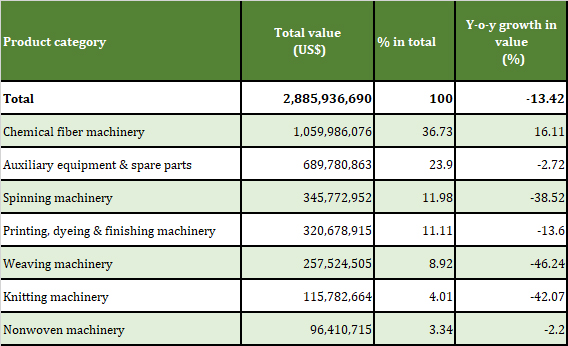

In 2020, China imported more than US$ 2.88 billion worth of textile machinery from 73 countries and regions, decreased by 13.42% year-on-year.

By product category, chemical fiber machinery ranked the first, with import amounting to US$ 1.06 billion, up 16.11% year-on-year, accounting for 36.73% of the total. Except for the chemical fiber machinery, the seven major product categories all had different degrees of decline.

Table 2: Import of Textile Machinery by Product Category in January-December 2020

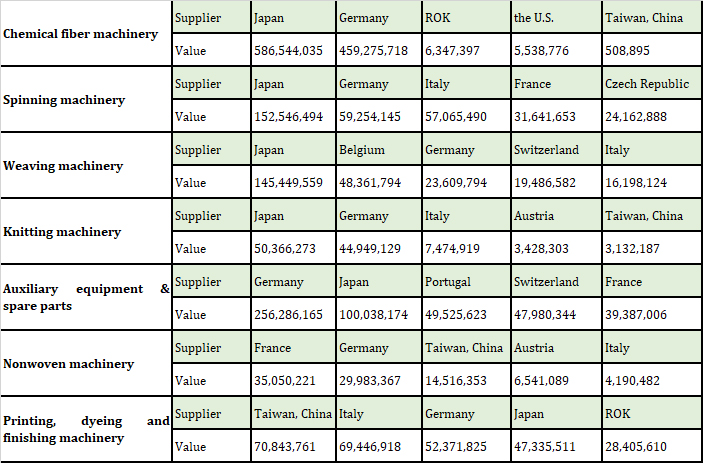

Table 3: Import of Major Categories of Textile Machinery by Supplier in January-December 2020

Unit: US$

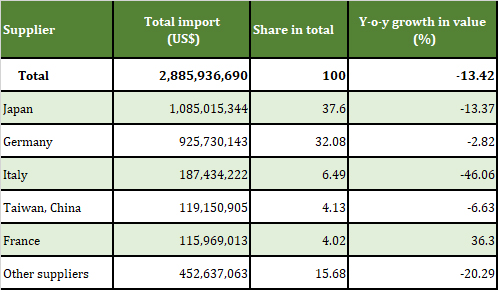

In 2020, the top five suppliers of China's imported textile machinery are Japan, Germany, Italy, Taiwan, China and France, with a trade volume of more than US$ 2.43 billion, down 12% year-on-year, accounting for 84.32% of the total import.

Table 4: Import of Textile Machinery from Top Suppliers in January-December 2020

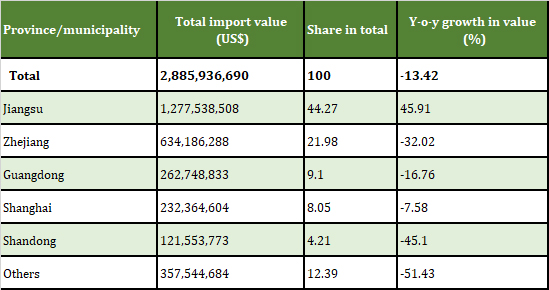

In 2020, 28 provinces/municipalities/autonomous regions imported textile machinery from abroad. Jiangsu, Zhejiang, Guangdong, Shanghai and Shandong are top five importers, whose import accounted for 87.61% of the total.

Table 5: Top Five Textile Machinery Importers in January-December 2020

2. Export

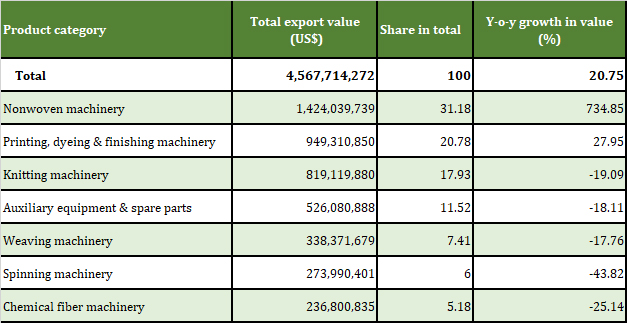

In 2020, China exported over US$ 4.56 billion worth of textile machinery, up 20.75% year-on-year.

Table 6: Export of Textile Machinery by Product Category in January-December 2020

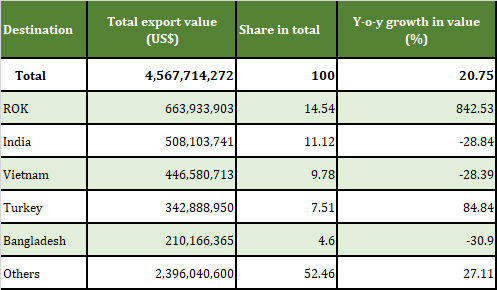

In 2020, China exported textile machinery and equipment to 192 countries and regions. The top five destinations are ROK, India, Vietnam, Turkey, and Bangladesh.

Table 7: Main Destinations of China's Textile Machinery Export in January-December 2020

III. Prospects of the industry situation

The Covid-19 pandemic has wreaked havoc on global development. Although the Covid-19 pandemic has brought uncertainty to industry enterprises at the beginning, it also brings opportunities. The advantages of China's textile industry chain and the rapid response ability of textile enterprises have become more prominent amid the Covid-19 pandemic. The increase in textile orders has also stimulated the demand for intelligent textile machinery equipment. At the same time, driven by the global demand for textile equipment for epidemic prevention, China's exports of textile machinery have also increased significantly. Based on the policy support for the economic recovery provided by major economies and vaccination, the global economy is expected to achieve a slow recovery in 2021. The International Monetary Fund (IMF) recently raised the forecast of the global economic growth rate in 2021. The forecast of 5.2% is revised up to 5.5%. Epidemic control and prevention in the world is expected to improve following mass Covid-19 vaccination, leading to the gradual increase in global consumer demand, and the gradual recovery of global investment. All these factors may drive the further recovery and development of the global manufacturing industry. However, the global industrial chain and supply chain are facing new changes due to geopolitics and trade protectionism of developed countries. In 2021, the international environment facing China's economic development will still be complicated, and the development of the textile machinery industry will still face many challenges.

Although China's development still faces many risks and challenges, the fundamentals of long-term economic improvement have not changed. The textile machinery industry still has the potential to develop. As the first year of China's 14th "Five-year Plan" period (2021-2025), China will continue to implement a proactive fiscal policy and a prudent monetary policy in 2021, so as to support the recovery of the market and industry. The 2021 Report on the Work of the Government pointed out that stabilizing and expanding consumption. On the strategic basis of adhering to the expansion of domestic demand, the textile industry amid the transformation and upgrading that relies on a strong domestic demand market will maintain sustainable development momentum. This will also help boost the confidence of corporate investment, offering demand to the textile machinery industry. The external factors such as the adjustment and reconstruction of the global industrial chain and supply chain, the advancement of the "Belt and Road" Initiative, the Regional Comprehensive Economic Partnership Agreement (RCEP), also expand export markets for the textile machinery industry, providing opportunities for the recovery and development of the textile machinery industry. At the same time, with the development of new-generation information technologies such as 5G, artificial intelligence, Internet of Things, and cloud computing, the level of intelligent manufacturing in the textile machinery industry improves gradually, which greatly enhances the competitiveness of China's textile machinery industry. Under a "dual circulation" development pattern, the textile machinery industry will do more on the supply side. Enterprises in the textile machinery industry must always focus on the demand of the market, so as to provide high-quality, innovation-driven products.

Source: CHINA TEXTILE LEADER Express

Authority in Charge: China National Textile and Apparel Council (CNTAC)

Sponsor: China Textile Information Center (CTIC)

ISSN 1003-3025 CN11-1714/TS

© 2026 China Textile Leader, all rights reserved.

Powered by SeekRay