2020/10/10

In 2020, the new coronavirus pandemic wreaked havoc on the global economy. According to the prediction of the World Bank in June 2020, the global economy will decline by 5.2% year-on-year in 2020, falling into the worst recession since World War II.

Against the background that the global economic recession has become a foregone conclusion, restricted international trade, declining incomes, and rising unemployment have all caused a severe decline in market demand. Textiles and apparel with dual attributes of rigid and elastic demand have also encountered severe challenges. Due to the pandemic, "new social distancing" and "stay at home economic" will also affect the consumption space, consumption patterns and consumption habits of the textile and apparel markets at home and abroad.

I. Changes in China's textile and apparel consumer market

With the upgrading of people's consumer demand and the improvement of consumption levels, textiles and clothing not only have the rigid demand attributes as daily necessities, but also their elastic demand attributes gradually present, including fashion, functionality, and ecological safety, playing a unique dual-attribute role in the field of consumer goods.

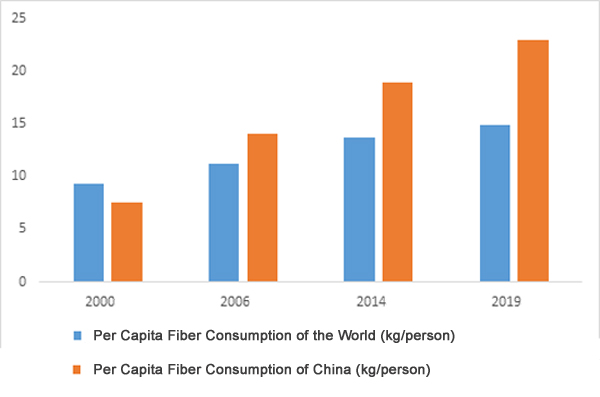

In recent years, with the improvement of China's economy, the income level of rural and urban residents has grown continually. With the daily necessities attribute of textiles and garment has been basically satisfied, there are ever more market space for people's quality demand, all of which have laid a solid foundation for the continuous growth of the domestic textile and apparel consumer market. Nowadays, China has become the world's largest textile and apparel consumer market. China's per capita fiber consumption has exceeded the world average level since 2006, and has reached the level of a moderately developed country. In 2019, China's domestic per capita fiber consumption reached 23 kg/person, which was higher than the global per capita fiber consumption (14.9 kg/person) in the same period, seeing an increase of 206.6% from 2000 (Figure 1). It can be seen that the scale of China's textile and apparel consumption has seen a rising trend in recent years.

Figure 1: Comparison of Per Capita Fiber Consumption Between China and the World

Source: Research Center of Industrial Economy of CNTAC; The Fiber Year 2020

However, due to the sudden impact of the COVID-19 pandemic in 2020, China's garment consumer demand has been significantly curbed, and consumers' consumption patterns and consumption habits have also undergone major adjustments.

1. The pandemic interrupted the rising trend and curbed the market demand

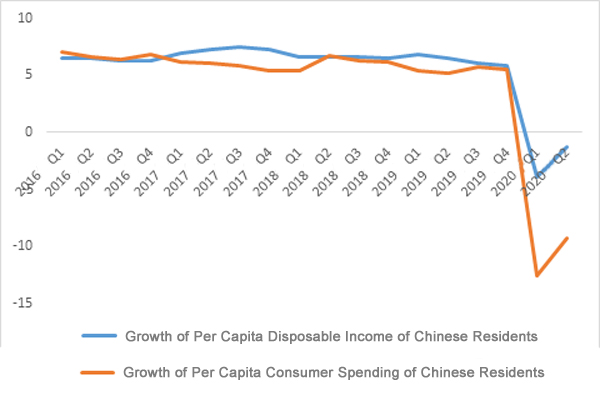

Theoretically, consumer demand and income level are positively correlated. From 2016 to 2019, the compound annual growth rate of per capita disposable income of Chinese residents reached 8.9%. The average annual growth rate of per capita consumer spending of residents was 8.0% (Figure 2). However, since 2020, the spread of the epidemic as well as economic downward pressure took a heavy toll on China's economy and employment situation, interrupted the rising trend of China's consumption for many years. According to statistics, from January to June 2020, the national per capita disposable income of residents was CNY 15,666, which actually fell by 1.3% (price-adjusted actual growth rate). Among them, the per capita disposable income of urban residents was CNY 21,655, dropped by 2.0%; and the per capita disposable income of rural residents reached CNY 8,069, down 1.0%.

Figure 2: Growth of Per Capita Disposable Income of Chinese Residents Since 2016

Source: National Bureau of Statistics

The double decline of the actual residents' income and the expected income has brought about a rapid decline in consumer spending. Especially under the impact of the coronavirus, the income of most groups in China has fallen, and the vulnerability of low-income groups has increased significantly, and their cautiousness in consumption choices has become more prominent. According to statistics, from January to June 2020, the per capita consumer spending of residents was CNY 9,718, down 9.3% (price-adjusted actual growth rate). Among them, the per capita consumption expenditure of urban residents was CNY 12,485, decreased by 11.2%; the per capita consumption expenditure of rural residents was CNY 6,209, declined by 6.0%. The decline in domestic consumer spending was significantly higher than the decline in income.

2. The structure of Consumer spending changed, clothing consumption shrank

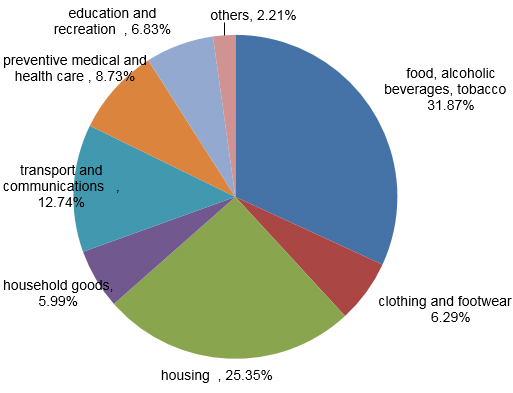

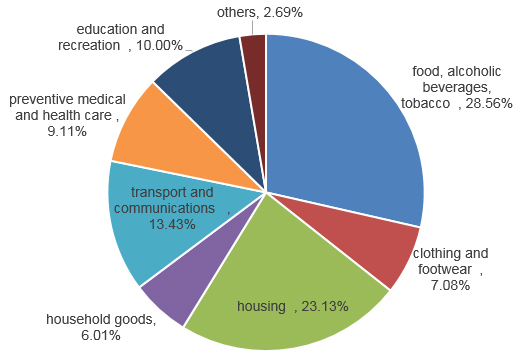

Affected by the obvious decline in consumer spending and the weakening of actual consumer demand, the structure of consumer spending has also shown significant changes. The proportion of basic subsistence goods (such as food and housing) has increased significantly, while the demand for commodities with optional attributes (such as clothing, education, culture and leisure) has plummeted. According to statistics, in the first half of 2020, per capita consumption expenditure on food, tobacco and alcoholic beverages accounted for approximately 31.9% of the total, up 3.3 percentage points year-on-year; per capita consumption expenditure on housing accounted for approximately 25.4%, grew by 2.2 percentage points compared with the same period last year; per capita consumption expenditure on clothing accounted for about 6.3%, seeing a year-on-year decrease of 0.8 percentage points (Figure 3).

Figure 3: Breakdown of Chinese Consumer Expenditure as of H1, 2020

Source: National Bureau of Statistics

Figure 4: Breakdown of Chinese Consumer Expenditure as of 2019

Source: National Bureau of Statistics

Therefore, textiles and clothing consumption shrank significantly. According to the National Bureau of Statistics, from January to June, the retail sales of clothing, foot & head wear and knitted goods above designated size reached 512 billion, dropped by 19.6% year-on-year, which was 32.5 percentage points and 24.8 percentage points lower than the growth rate of retail sales of grain, oil, food and daily necessities in the same period.

3. Accelerating changes in consumption habits and online transformation

Nationwide virus control is now being conducted on an ongoing basis, which prompts new consumption patterns and consumption habits. According to the relevant survey data of the China Consumers Association, online consumption has obviously replaced offline consumption. Nearly 60% of surveyed consumers said that their online consumption exceeds offline consumption, and 70.6% of consumers spend more time on online shopping.

According to the National Bureau of Statistics, from January to June, online retail sales reached CNY 5.15 trillion, up 7.3% year-on-year. Among them, the online retail sales of physical commodities reached about CNY 4.35 trillion, up 14.3%, accounting for 25.2% of the total retail sales of consumer goods. Taking the "618 Shopping Festival" in 2020 as an example, JD.com and Tmall's cumulative order amounts totaled CNY 269.2 billion and CNY 698.2 billion respectively, both setting new records. Thereinto, clothing, foot & head wear and knitted commodities ranked first in online retail sales.

Long-time online working and entertainment have become the norm, which has accelerated the use of online marketing and community marketing to connect consumers. Take Shishi, an important industry cluster of China's textile and garment industry in Fujian Province, as an example. In the early stage of the epidemic, it focused on live streaming, which promoted many local apparel enterprises and live streaming platforms to sign CNY 150 million worth of intentional purchase agreements. The sales via live streaming reached CNY 119 million.

II. Trend outlook of China's textile and market in the post-epidemic era

At present, although the domestic epidemic situation continues to become better, the global pandemic prevention and control situation are still very severe. Globalization has brought huge uncertainty to China's macroeconomic recovery. Changes in consumption may become one of the biggest impacts of the new coronavirus in 2020. As for the global textile and apparel market, the decline in global consumer spending is a foregone conclusion, the consumption habits will continue to change at an accelerated pace, and the layout of the international textile trade will also face new adjustments.

1. Decline in consumption capacity of domestic and foreign apparel

Since 2020, a deepening global recession, business bankruptcies and layoffs have become a new norm. Residents' consuming capacity has weakened, and consumer willingness has declined. The market demand for textile and apparel products has significantly weakened. The textile industry, especially apparel, has faced unprecedented export pressure. Most well-known brands take measures to cancel orders to stop losses. For example, H&M only sells its classic spring stocks until autumn. The World Bank predicted that global per capita income will fall by 3.6%, and the number of economies with declining per capita income hit the highest level since 1870. Investment bank Bryan Garnier & Co. predicted that the pandemic will shrink the US$ 2.5 trillion worth of global fashion industry by 30%.

2. Apparel and accessories consumption will show new characteristics

According to The State of Fashion 2020 released by McKinsey, consumers will become more and more interested in shopping on social platforms, and their shopping needs will develop towards convenience and immediacy, as well as eco-friendly products. Therefore, brand owners will invest more on new media platforms and traditional platforms, add more distinctive community stores, and focus on the recycled development and application of waste fibers and textiles. Brand owners will explore and research raw materials that meet sustainable development, including the recreation of original materials and high-tech materials that have more advantages in aesthetics and functionality. In addition, consumers expect apparel and brands to be diverse and inclusive.

3. The regionalization of international supply chains will become increasingly apparent

Competition in the international market will become increasingly fierce, and the trend of supply chain regionalization will be obvious. Affected by rising labor costs in China, adjustments in international brand procurement strategies, and the return of manufacturing industries in developed countries, the distribution pattern of the global textile supply chain has begun to adjust before the outbreak of the new coronavirus. The share of China's textile and apparel products in the imported market like the United States, the European Union, Japan is declining. After the outbreak of the pandemic, countries will inevitably increase their consideration of further improving industrial security and economic security. The intensification of antagonisms and conflicts in development models and values will intensify the trend of anti-globalization. Therefore, the world may enter an era of limited globalization in the short to medium term.

Authority in Charge: China National Textile and Apparel Council (CNTAC)

Sponsor: China Textile Information Center (CTIC)

ISSN 1003-3025 CN11-1714/TS

© 2026 China Textile Leader, all rights reserved.

Powered by SeekRay