2024/1/15

Since the beginning of this year, the Chinese government has implemented a wide array of measures to incentivize consumption and facilitate an all-encompassing resurgence in the consumer landscape, resulting in a gradual recuperation of both household income and consumer assurance. Chinese chemical fiber industry faced a weak recovery amidst high production and start-up rates, contrary to the “strong expectations” that were held. As a result, the seasonality of the market was more pronounced than anticipated, with the average prices of major chemical fiber products declining and shrinking profits putting a strain on corporate profitability. Compared to previous years, the Spring Festival had a stronger impact this year, resulting in a decrease in industry performance during the first quarter. However, the chemical sector exhibited a gradual resurgence during the second and third quarters, ultimately resulting in a general enhancement of profitability. Moreover, the export of chemical fibers showed significant improvement, with polyester products leading the way with a growth rate of over 20% in the first three quarters.

I. Production & Sales

From March onwards, the industry has sustained a notable level of overall operating load. Taking the direct-spun polyester filament as an example, it has yielded positive results with an average operating load of around 84% during the second quarter and about 90% in the third quarter. Amidst the customary peak season in October, the demand from downstream markets remains strong, and the average operating load rate maintains a 90% level. Furthermore, in light of the Asian Games, there was a noticeable decrease in output in the Xiaoshan and Shaoxing districts; however, business activities promptly resumed following the conclusion of the National Day festivities.

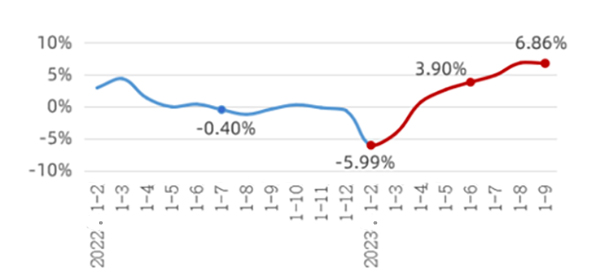

According to the National Bureau of Statistics, the output of chemical fibers in the first three quarters this year totaled 52.30 million tons, seeing year-on-year growth of 6.86%, 7.18 percentage points higher than the same period last year. The growth rate showed a gradual upward trend, that of the first three quarters was 2.96 percentage points higher than the growth rate in the first half of this year. By Provinces and municipalities, the output of chemical fibers in Zhejiang Province increased by 4.7% year-on-year in the first three quarters; Jiangsu Province, up by 19.6% year-on-year; Fujian Province, down by 7.6% year-on-year.

Figure 1: Y-o-Y Growth Change of Chemical Fiber Output Since 2022

Source: National Bureau of Statistics

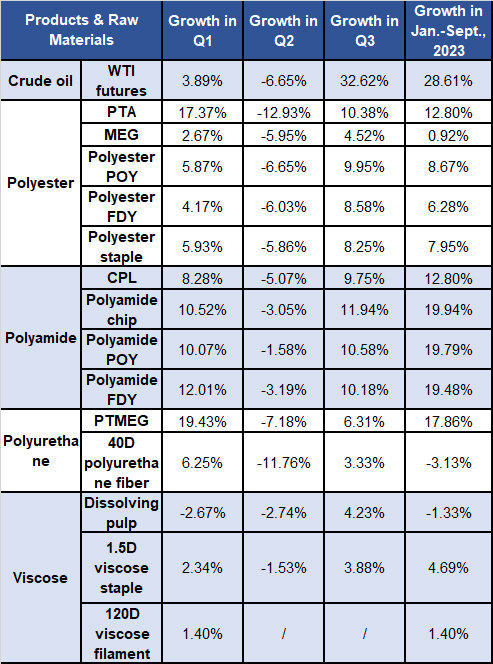

II. Market & Price

Table 1: Price Change of Main Chemical Fibers and Raw Materials

III. Foreign Trade

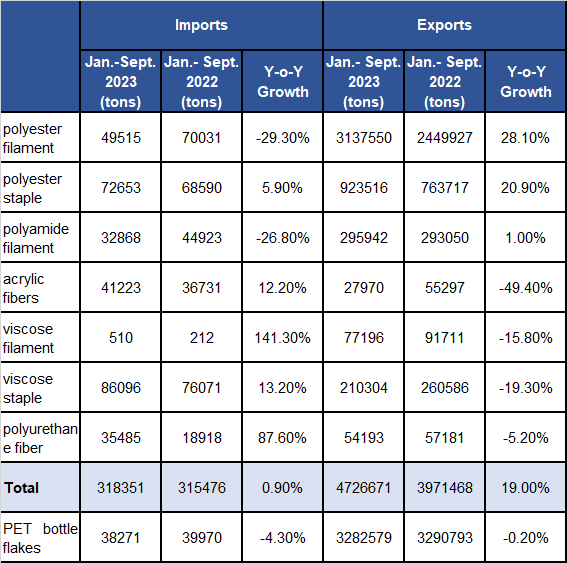

According to Chinese Customs, the exports of main chemical fibers totaled 4.73 million tons, growing by 19.0% year-on-year, with 1.6 percentage points higher than that of the first half.

Table 2: Foreign Trade of Chemical Fiber Products in Q1-Q3

Source: Based on data from Chinese Customs

IV. Domestic & External Demand

The domestic market vitality for textiles and apparel has shown strong growth since the start of this year, maintaining a fast-paced momentum. National Bureau of Statistics data show that in the first three quarters, China’s retail sales of clothing, foot & head wear and knitted goods grew by 10.6% year-on-year, 14.6 percentage points rebounded from the same period last year, hitting second place among the 16 major categories of goods. Throughout the Mid-Autumn Festival and National Day break, there was a notable surge in consumer demand for textiles and apparel, resulting in a significant 17.5% year-on-year increase in sales for major retail giants in the clothing sector across the nation. Online retail sales of wearing goods increased by 9.6% year-on-year, 4.9 percentage points faster than the same period last year. But compared with the growth rate of food categories, that of the wearing goods saw a slower growth.

Due to the impact of decreased international demand, a volatile trade climate, and other contributing factors, China’s textile sector has experienced a notable increase in export pressure this year. However, certain markets continue to show positive growth in exports. According to data from China Customs, China’s textile and apparel exports in the first three quarters of this year amounted to US$ 223.15 billion, seeing a year-on-year decrease of 10.1%. Among the main exported products, the exports of textiles, including yarns, fabrics, and manufactured products, totaled US$ 101.92 billion, down by 10.3% year-on-year; apparel exports amounted to US$ 121.23 billion, down by 8.8% year-on-year. China’s textile and apparel exports to major markets such as the United States, the European Union, Japan, and ASEAN all declined compared to the previous year. However, exports to Turkey and Russia, as well as the countries involved in the Belt and Road Initiative (BRI), experienced year-on-year growth of 6.2% and 20.1%, respectively.

V. Economic Benefits

The chemical fiber industry’s economic efficacy in the first three quarters remains in line with the 2022 downward trend. Nevertheless, quarter-on-quarter analysis of efficiency indicators indicates a gradual progression, with yearly decreases in operating income and total profits gradually shrinking, and a downward trend in the growth rate of loss-making enterprises. According to the National Bureau of Statistics data, the operating income of China’s chemical fiber industry grew by 2.81% year-on-year in the first three quarters. And the revenue margin reached 1.67%, 0.51 percentage points higher than that of the first half.

Concerning classification, the profitability of polyester POY in the second half of the year excels that of the first half, particularly in May, June, September, and October. But its profitability declined since November. Despite maintaining profitability, the acrylic sector’s performance in the second half has been weaker compared to the first half. The financial viability of polyamide FDY surpasses that of polyamide POY. The loss value of viscose staples was narrower than before.

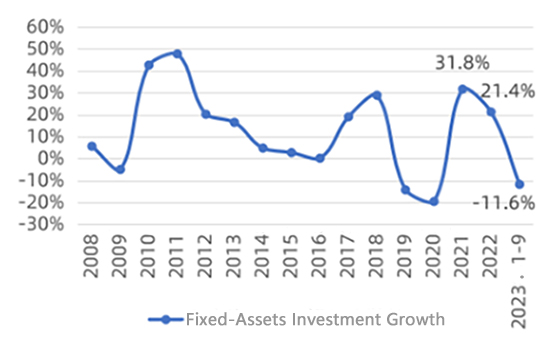

VI. Fixed-assets Investment

According to the National Bureau of Statistics, the fixed-asset investment in the chemical fiber industry fell by 11.6% year-on-year in the first three quarters of this year, 4.6 percentage points higher than that of the first half. However, on the other hand, nearly 10 million tons of polyester production capacity have been put into operation so far.

Figure 2: Fixed-Assets Investment Growth of the Chemical Fiber Industry from 2008

Source: National Bureau of Statistics

VII. Market Forecast

Over the course of time, as the economy maintains its recovery, employment situations steadily advance, and market supply undergoes consistent optimization, the implementation of the consumption promotion policy will reinforce the foundation for revitalizing and expanding consumption. The prevailing forecast appears favorable and is expected to provide substantial support for China’s chemical fiber market. Nevertheless, the primary concern plaguing the sector remains the potential for enhancing the supply and demand dynamics. It is anticipated that a prolonged period will be required to rectify the development cycle. The upcoming year is promising for the chemical fiber industry. In particular, it is anticipated that the pressure on the supply side will be alleviated. From the beginning of 2024, the expansion of polyester filament capacity will enter a limited range, thereby mitigating the escalation of potential supply and demand conflicts. The demand-side potential is expected to be released. Due to the implementation of a series of measures aimed at boosting domestic demand, the domestic sales of China’s textile and apparel industry have been secured. Moreover, there is still untapped growth potential, particularly in the diversified consumer markets, as well as the expanding industrial use of technical textiles and the emergence of innovative forms of online retailing. As for export sales, with the change in China’s textile industry’s international division of labor status, the structure of foreign trade in different products is adjusting and optimizing. It is expected that the share of chemical fibers and relevant products exports will continue to show good momentum.

Source: CHINA TEXTILE LEADER Express

Authority in Charge: China National Textile and Apparel Council (CNTAC)

Sponsor: China Textile Information Center (CTIC)

ISSN 1003-3025 CN11-1714/TS

© 2026 China Textile Leader, all rights reserved.

Powered by SeekRay