2019/11/27

Since the beginning of 2019, the domestic and international business environment of China's textile industry has become more severe. The challenges and difficulties have increased significantly with the slowdown in market demand and the risk of trade environment. However, China's textile industry is committed to deepening the supply-side structural reform and accelerating its transformation and upgrading. Under the increasing pressure of production and operation, the resilience against the downward risk remained, and the prosperity stayed in the expansion range. The economic operation situation was basically in line with the external situation.

Industry Prosperity Continued to Expand, and the Production Achieved Low Growth

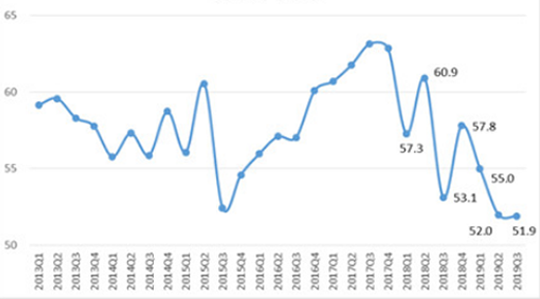

In the first three quarters of 2019, the prosperity index of China's textile industry has continued to expand. According to the survey data of the China National Textile and Apparel Council, the prosperity index in the third quarter was 51.9, maintaining at a range of expansion above 50, 0.1 percentage points lower than that of in the second quarter. It is expected that the prosperity index of the textile industry in the fourth quarter of 2019 will be 54.0, which is higher than the current prosperity index, indicating that the increased confidence of textile enterprises in the industrial operation in the fourth quarter.

Prosperity Index of China's Textile Industry

The operation of the textile industry was generally normal, and its production has maintained steady growth at a low speed. According to the National Bureau of Statistics, in the first three quarters of 2019, the capacity utilization rate of the textile industry (including spinning, weaving, dyeing and finishing, home textiles, technical textiles, etc.) reached 78%, slowing by 2.6 percentage points from the same period of the previous year; the utilization rate of the chemical fiber industry was 83.1%, 1.1 percentage points higher than the same period of the previous year. Both the utilization rate of the textile industry and the chemical fiber industry were higher than the capacity utilization level of the national industry (76.2%) in the same period. The industrial added value of enterprises above designated size in the textile industry increased by 2.9% year-on-year, and its growth rate was unchanged with the same period of the previous year, 0.7 percentage points slower than the first half of 2019. In all sectors of the industrial chain, the production growth of chemical fiber and industrial textile industry was more stable.

Exports Pressure Has Not Diminished, and the Online Retail Channel Has Grown Well

Since the beginning of 2019, the domestic market of China's textile and apparel industry has grown steadily and slowly, and online retail sales continued to maintain double-digit growth. According to the National Bureau of Statistics, in the first three quarters, the retail sales of clothing, foot & head wear and knitted goods above designated size increased by 3.3% year-on-year, and the growth rate slowed by 5.6 percentage points from the same period of the previous year, but accelerated by 0.3 percentage points from the first half of 2019, indicating a sustained and slightly rebounded trend. The national online retail sales of wearing goods grew by 18.6% year-on-year, declining by 4.7 percentage points and 2.8 percentage points respectively compared with the same period of the previous year and the first half of 2019.

The export pressure of the textile industry continued to increase. According to customs data, in the first three quarters, China's textile and apparel exports totaled US$ 208.62 billion, down 2.3% year-on-year. The growth rate slowed by 7 percentage points and 0.3 percentage points respectively compared with the same period of the previous year and the first half of this year. Among them, the textile exports amounted to US$ 94.3 billion, seeing a year-on-year increase of 0.4%; while the exports of garment reached US$ 114.31 billion, decreased by 4.5% year-on-year. Although Sino-US trade friction has not yet had an overall impact on the economic operation of the whole industry, the impact of the increased US tariff on exports has gradually emerged. In the first three quarters, China's exports of textiles and apparel to the United States decreased by 3.3% year-on-year. Due to the domestic textile bulk products such as apparel and home textiles have been subject to a 15% additional import tariff since September 1, the exports of China's textile industry to the United States fell by 18.8% in the same month.

Efficiency Growth Faced Increased Pressure, and the Investment Scale Has Declined

Since 2019, the profit pressure of the textile industry has increased, but some sectors in the industrial chain maintained good benefits. In the first three quarters, the operating income of 34,000 textile enterprises above designated size in China achieved CNY 3.71 trillion, up 1.5% year-on-year, 2.7 percentage points slowed down from the same period of the previous year; the total profit reached CNY 156.15 billion, declined by 7.6% year-on-year, 14.7 percentage points lower than the same period of 2018; the profit rate of operating income was 4.2%, which was 0.4 percentage points lower than the same period of 2018. In each sub-sector, the total profit of filament industry, printing and dyeing industry, as well as knitting industry increased by 7.9%, 4.7% and 3.7% respectively, which were higher than the growth rate of the textile industry by 15.5%, 12.3% and 11.3% respectively; and the profit margins of apparel industry, technical textiles industry and the textile machinery industry were all stable at a high level of 5.2%, 5.0% and 6.8%, respectively, basically unchanged with the same period of the previous year.

The scale of fixed-assets investment in the textile industry has been reduced, and the regional layout has been continuously adjusted. In the first three quarters, the completed investment in fixed assets in the textile industry decreased by 7% year-on-year. By sectors, the investment in the textile industry, garment industry and chemical fiber industry decreased by 8.2%, 2% and 15.4% respectively. In terms of regions, Fujian Province, Hubei Province, Hunan Province and Chongqing City all showed a good momentum of positive investment in the whole industry chain, becoming the regional highlights.

Future Uncertainty Will Maintain, and High-quality Development Are Urgent

In the fourth quarter of 2019 and the coming 2020, the complexity and uncertainty of the development environment of China's textile industry will continue. The slowdown in global economic growth has become a general expectation. At this stage, the lack of growth drivers and the rising risk in the international trade environment have become the influencing factors of normalization. It is an inevitable and urgent development task for the textile industry to continuously improve its own self-development and face the domestic demand. At present, the Chinese government puts the work of ensuring stable employment, stable financial sector, stable foreign trade, stable foreign investment, stable domestic investment, and stable expectations in a more prominent position. The fundamental support of the overall macroeconomic stability and the strong domestic market are the primary driving force and the key to the future development of the textile industry.

Authority in Charge: China National Textile and Apparel Council (CNTAC)

Sponsor: China Textile Information Center (CTIC)

ISSN 1003-3025 CN11-1714/TS

© 2026 China Textile Leader, all rights reserved.

Powered by SeekRay