2019/11/11

I. Basic Situation of China's Textile Machinery Industry

With a complete industrial chain layout, China is the world's largest producer and exporter of textiles and garments. The textile industry is the pillar industry of China's national economy and important civilian production industry. At present, China's fiber processing volume accounts for more than 50% of the world's total, and the scale of the textile industry ranks first in the world. The development of the textile industry has driven the development of the textile machinery industry. China's textile machinery industry has a large scale and has formed a relatively complete industrial chain layout.

After China's economy has entered a new normal, the textile industry is also in a critical period of transition between new and old growth models. The only way to implement the transformation is to rely on technological innovation to drive development. Textile machinery is the equipment foundation of China's textile industry. Focusing on the needs of structural adjustment of the textile industry, developing high-end textile equipment technology, and improving the level of domestic textile equipment manufacturing is the important foundation and key for China's textile industry.

"Green Textile" is a prominent theme in the development of the textile industry in the 21st century. Therefore, environmentally friendly textile equipment that can improve resource utilization and reduce energy consumption has a broad market space. At the same time, the growth driven of the textile and garment industry has changed from production factors competition to comprehensive competition of scientific and technological strength. In the future, the textile and garment industry will no longer be a labor-intensive industry, but a technology-intensive, a creativity-intensive industry featuring high technology. Therefore, innovation, efficiency, environmentally friendly, digital technology and intelligence are the main development trend of the future textile machinery equipment.

II. The Scale of China's Textile Machinery Industry

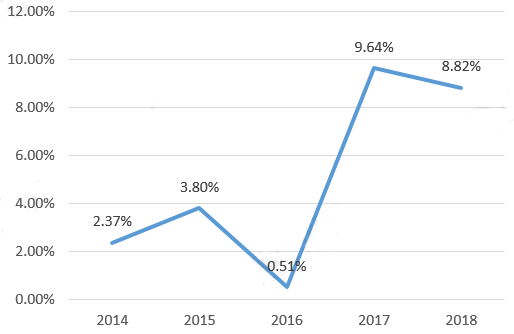

According to the statistics of China Textile Machinery Association, in 2018, the total assets of China's textile machinery industry was CNY 101.79 billion, seeing a year-on-year increase of 6.55%. The main business income reached CNY 91.16 billion, up 8.82% year-on-year. Its total profit reached CNY 6.83 billion, grew by 5.12% year-on-year. In recent years, in terms of sales revenue and total profit of textile machinery, the scale of China's textile machinery industry showed an upward trend as a whole. With the industrial restructuring, the medium and high-end textile equipment produced by domestic enterprises have developed rapidly, and the overall operation of the textile machinery industry has increased steadily.

Figure 1: The Year-on-year Growth Rate of the Main Business Income of Textile Machinery Enterprises in 2014-2018

(Unit: %)

Source: China Textile Machinery Association

According to the estimates released by the China Textile Machinery Association, by the end of 2018, there are 658 textile machinery enterprises above designated size in China, mainly concentrated in Jiangsu Province, Zhejiang Province and Shandong Province. At present, domestic equipment accounts for about 80% in China's market.

III. The Trend of the Industry's Profit Level

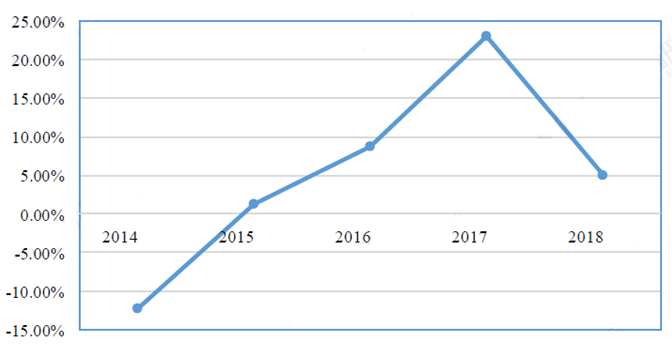

A. Changes in total profit of the industry

According to China Textile Machinery Association, the total profit of the textile machinery industry in 2018 was CNY 6.83 billion, increased by 5.12% year-on-year. From 2014 to 2018, the total profit of the textile machinery industry generally showed an upward trend, and its amount was basically maintained at about CNY 8 billion.

Figure 2: The Growth Rate of the Total Profit of Textile Machinery Enterprises in 2014-2018

(Unit: %)

Source: China Textile Machinery Association

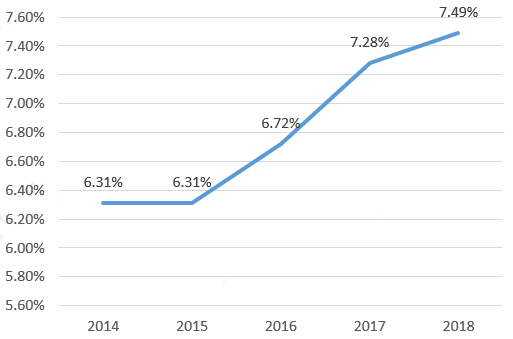

B. Changes in sales profit margin

In recent years, with the continuous improvement of the technical level of China's textile machinery industry, the industry's sales profit margin has generally shown an upward trend.

Figure 3: The Sales Profit Margin of China's Textile Machinery Enterprises in 2014-2018

(Unit: %)

Source: China Textile Machinery Association

The changes in profit levels are mainly due to the following reasons. Firstly, in the mid-to-late period of the "12th Five-Year Plan" (2011-2015), the world economy recovered slowly, the domestic economy has shifted from high-speed growth to the new normal of medium-to-high-speed growth, and the growth rate of China's textile industry has slowed significantly. As the upstream of the textile industry chain, the textile machinery industry was inevitably subject to greater impact. Second, insufficient domestic and international market demand has led to problems such as bad competition in the textile machinery industry. The phased structural adjustment of the textile machinery industry has restrained the improvement of the industry's profit level to a certain extent. Finally, since 2016, China's textile machinery industry has focused on deepening supply-side reform. With the booming of the downstream textile industry and the recovery of the textiles and export markets, the orders and product prices have shown an upward trend, and the industry's profit level has improved.

IV. The Demand for Textile Machinery Products Picked Up

The prosperity degree of the textile machinery industry is closely related to that of the downstream of textile industry. According to the data, the textile industry has entered a period of decline since 2013. From the second half of 2016, the overall recovery of the industry has shown signs, which has led to a rebound in the prosperity index of the textile machinery industry. In 2018, the profit of the textile industry totaled CNY 276.61 billion, up 8.0% year-on-year.

V. Industrial and Consumption Upgrading Drive High-end Textile Machinery Market

The textile industry is dominated by labor-intensive models and has a high dependence on labor resources. With the continuous improvement of domestic labor costs, China's labor cost advantage has gradually weakened, and business pressure has forced enterprises to eliminate backward production capacity. It is a general trend to introduce automation and high-speed textile machinery. Taking the spinning industry as an example, the average employment of 10,000 spindles has dropped from 80 in 2010 to about 60 in 2015. According to the Textile Industry Development Plan (2016-2020), the demand will drop to less than 20 by 2020.

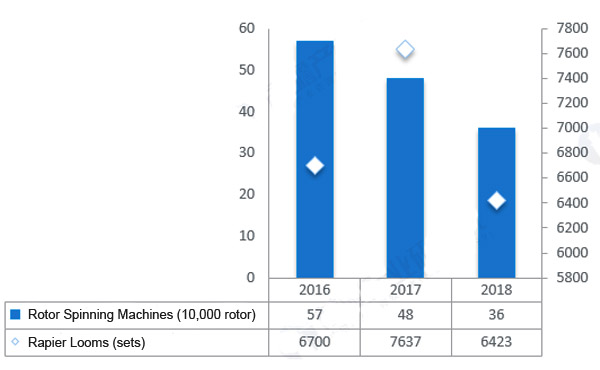

In recent years, the product structure of domestic textile machinery has been continuously adjusted. The intelligent textile machinery that improves the quality of yarns, and saves the labor request has become the first choice for domestic textile enterprises. The products such as the rotor spinning machine and rapier loom have an outstanding performance. In 2018, the sales of the main rotor spinning machines and rapier looms in China showed an overall growth trend.

Figure 4: The Sales of Rotor Spinning Machines and Rapier Looms in 2014-2018

(Unit: 10,000 rotor, sets)

Source: China Textile Machinery Association

The automation of textile machinery can not only improve the production efficiency of textile enterprises, increase their profitability, but also improve the level of informationization and integrated application, achieving the goal of "reducing staff, increasing efficiency, improving quality and ensuring safety". At present, the digitalization rate of domestic textile enterprises' production equipment is 36.06%, the networking rate of digital production equipment is 27.74%, the informationization penetration rate of production management is 50.49%, and the proportion of enterprises achieving control integration is 19.82%. In summary, the textile machinery industry will continue to advance in intelligent development routes featuring high-end, high-tech and high-value-added.

VI. Global Textile Industry Transfer and Structural Adjustment Bring New Opportunities for Growth

The global textile industry has experienced the migration process from Europe and the United States to Asia and Latin America. It has also experienced a gradual proliferation process from Japan to South Korea to Southeast Asia, South Asia and Central Asia. The industrial transfer will inevitably accompany the capital investment of fixed assets, which is expected to provide space for the growth of new purchase demand for textile machinery in these regions, which provides a huge market opportunity for China's textile machinery exports.

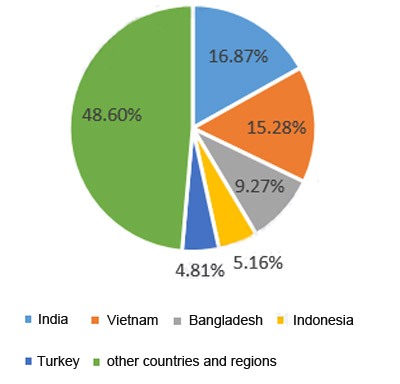

China's textile machinery is mainly exported to India, Vietnam, Bangladesh, Indonesia, Turkey, etc., of which India is the largest market for textile machinery exports. In 2018, China exported US$ 2.64 billion worth of textile machinery to the countries along the "Belt and Road" route, accounting for 72.06% of China's total exports of textile machinery, seeing a year-on-year growth of 2.44%. Meanwhile, with the resource superiority of Xinjiang Province and the improvement of the investment environment, the textile production capacity in the eastern region is expected to accelerate to the central and western regions, especially after the implementation of multiple policies for the promotion of employment in the textile and garment industry.

VII.The Import and Export of Textile Machinery Industry

A. General situation of foreign trade volume of textile machinery industry

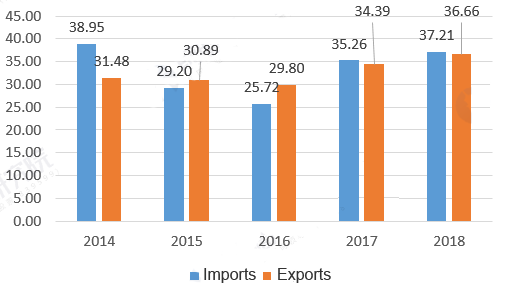

According to customs statistics, the foreign trade volume of textile machinery in China in 2018 totaled US$ 7.38 billion, up 6.78% year-on-year. Among them, the exports of textile machinery reached US$ 3.66 billion, increased by 7.20% year-on-year; while the imports were US$ 3.72 billion, up 6.36% year-on-year. From 2014 to 2018, China's textile machinery exports showed increase trend based on stable development, and the total amount of imports showed a downward trend.

Figure 5: Foreign Trade Volume of China's Textile Machinery

(Unit: US$ 100 million)

Source: China Textile Machinery Association

B. Destinations of China's textile machinery exports

In the whole year of 2018, China exported US$ 3.66 billion worth of textile machinery to 188 countries and regions, seeing a year-on-year increase of 7.20%. The top five destinations were India, Vietnam, Bangladesh, Indonesia and Turkey.

Figure 6: Destinations of China's Textile Machinery

(Unit: %)

Source: China Textile Machinery Association

India is the second-largest cotton producer in the world, and its textile industry ranks second in the world and is one of India's important industrial sectors. In addition to spinning equipment, the local textile machinery in India has insufficient capacity to meet local demand. In recent years, Gujarat, Maharashtra and Rajasthan in India have introduced a number of preferential policies for the textile industry to strongly encourage the development of the textile industry, including providing subsidies for loans interest in accordance with the amount of investment in the construction of the factory, etc. A number of policies aim to improve the production technology, infrastructure level and product development level of Indian textile companies, which brings new opportunities for the export of China's new textile machinery equipment such as rotor spinning machines and high-speed rapier looms.

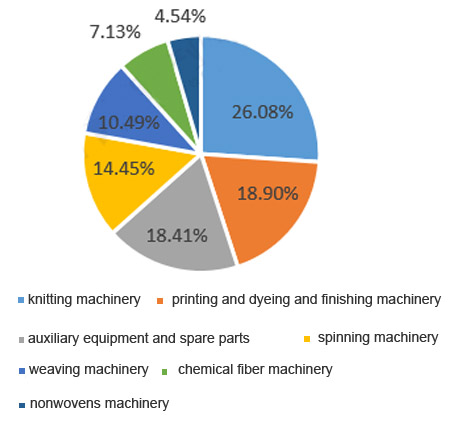

C. Export products of China's textile machinery

In 2018, the exports of China's textile machinery reached US$ 3.66 billion, of which the exports of knitting machinery amounted to US$ 956 million, accounting for 26.08%, ranking first. And then, it was followed by printing and dyeing and finishing machinery, auxiliary equipment and spare parts, spinning machinery, weaving machinery, chemical fiber machinery and nonwovens machinery. The exports of spinning machinery, weaving machinery as well as printing and dyeing and finishing machinery accounted for 14.45%, 10.49% and 18.90%, respectively, up 27.24%, 6.46% and 4.20% year-on-year.

Figure 7:Export Category of China's Textile Machinery

(Unit: %)

Source: China Textile Machinery Association

D. The manufacturing level of high-end textile machinery parts is limited

There is a certain gap between the overall level of China's textile machinery manufacturing industry and the world's leading level. The lack of high-end technology and stability of high-end textile machinery parts manufacturing has become a bottleneck restricting the development of China's high-end textile machinery industry. Textile machinery is becoming more and more high-speed, high-yield and automated. Domestic textile machinery parts mostly occupy the middle or low-end market, while the high-end market is more monopolized by foreign companies. In recent years, the import volume of auxiliary equipment and spare parts of textile machinery has increased year by year. In 2018, the import volume of auxiliary equipment and spare parts ranked first among the total imports, with an import value of US$ 899 million, increased by 7.73% compared with 2017, accounting for 24.15% of all textile machinery imports.

Authority in Charge: China National Textile and Apparel Council (CNTAC)

Sponsor: China Textile Information Center (CTIC)

ISSN 1003-3025 CN11-1714/TS

© 2026 China Textile Leader, all rights reserved.

Powered by SeekRay